The Latest from TechCrunch |  |

| Risk Aversion And The Perils Of Selling Too Early (Israeli Startups, Part II) Posted: 28 Mar 2009 08:30 AM PDT

Right now I'm at an un-conference called KinnerNet. It's hosted by famed Israel entrepreneur Yossi Vardi and set near the Sea of Galilee. Funny thing: There are a few hundred entrepreneurs here, mostly Israeli. And only one has said something negative to me about my post earlier this week about the poor venture returns for Israeli startups that incited such passionate feelings everywhere else in the world. No one is arguing that the returns have been good for Israeli companies in the last eight years. But there are some legitimate questions about how Dow Jones (whose numbers I used) slices its data and how the numbers could be quite so low. Since 2001, according to Dow Jones, $10 billion in venture investments have yielded only $860 million in IPO and M&A exits. The study of venture economics is at best imperfect, so it's quite likely there are several big Israeli exits the numbers are missing. It's like measuring Web traffic. Most Internet companies will tell you their traffic logs report higher numbers than measurement agencies like Hitwise or comScore. But the Dow Jones numbers aren't likely to be off by, say, a factor of 50 or 100. And since the same sources—usually venture firms—give firms like Dow Jones the investment data and the liquidity data, the relationship between the money going in and the money going out is pretty reliable, even if the absolute numbers are not. Put another way, if Dow Jones is missing some exits, they're likely also missing some investments going into the country. In any case, the returns are down dramatically from the 1990s—period. Be mad at me all you want; those are still the numbers. The more interesting question—and I think what's creating such passion around the topic—is why the numbers are down? We're actually going to do a session on this tomorrow at KinnerNet. It's also the one question I've been asking Israelis pretty much non-stop for the week I've been in the country. Two interesting cultural answers have emerged that I wouldn't have imagined. Both have to do with a phenomenon that's hurt venture returns in the United States too: Entrepreneurs selling companies too early. Both Roi Carthy (who occasionally writes for TechCrunch from Israel) and Matthew Hertz, who's starting a deep-web people search company called Pipl.com, said many Israelis live in the "temporary." Put another way, when Matt heard I was filling in for Michael Arrington "temporarily" in February, he laughed and said, "We Israelis know temporary is the most permanent state there is. Short-term is a way of thinking here." (True enough, it's March, and I'm still here writing on TechCrunch.) That "temporary" mindset drives the same unabashed courage that makes quitting a job and starting a company so natural for Isreali entrepreneurs. But both Carthy, Hertz and a dozen or so other entrepreneurs I spoke with said there's a flip side to that: When you live for the short term, and you get a $30 million acquisition offer; you're more likely to take it. In other words, several entrepreneurs here have described themselves as having a huge appetite for taking risk on the front end; but being risk-adverse when it comes to turning down a huge chunk of money for a $1 billion IPO dream. In my last book, David Sachs, an American entrepreneur who was the COO of PayPal and has started Geni and Yammer since, put the same feeling another way: Most people in the world would take the certainty of $1 million over a chance they could make $30 million. I'm not knocking that. I'll sell SarahLacy right now for $1 million. (Takers?) But I tend to think of people who make that decision as being risk-adverse. What was surprising to me, is that people who have a huge tolerance for risk on the front end– literally creating something out of nothing—become risk-adverse when they've proven that it's actually worth something. I was discussing this idea last night with Nimrod Lev, who sold kSolo to MySpace and has worked in the Israeli Internet scene since its earliest days. He had a different cultural take on the same phenomenon. He said the fun part for Israelis, or at least for him, is solving a hard, technical problem. In other words, "the art of the hack." Once it's solved, managing the company, growing revenues, taking on HR problems—all of that is the boring part. He loves starting companies and has been successful at it, but he has zero desire to build one into the next Google. There are a lot of guys like that in the Valley, too, but they've also got a huge pool of experienced managers to hand the company off to. I'll give Israel another reason that returns have fallen so hard on a percentage-basis. And it has nothing to do with Israeli culture. In fact, it's something the United States screwed up: Sarbanes Oxley. SarbOx put a chill on small-but-growing companies' ability to go public on the Nasdaq. The costs of being SarbOx-compliant are so high, that unless you have more than $40 million or so in annual revenues and strong growth, it's just not cost effective. And other regulations surrounding the Chinese Walls between research and trading mean that small companies get little research coverage and are too thinly traded to really be considered liquid stocks. This has hurt the Valley, when it comes to returns, for sure. But the Valley also is replete with large companies that buy each other for enough money that investors can eke out enough to keep going. Geographic proximity does help in working these kinds of things out. (You think YouTube didn't benefit from sharing an investor with Google? VCs actually count this as one of their so-called "value adds.") A good number of European companies have gotten around the SarbOx problem by going public on the London exchange over the last few years, to the extent where several articles were written about the London Stock Exchange becoming a bigger financial force than the Nasdaq. So if it was a problem for all startups, why do I bring it up in relation to Israel? Because pre-Sarbanes Oxley, Israel had more Nasdaq-traded companies than any other country. Outside the Valley, they were, by definition, the most vulnerable to the change. Perhaps in the intervening years, it's not the entrepreneurs that have lost their mojo; there's just no good financial system for their investors to profit off of said mojo. That's certainly a hack I'd like to see a smart Israeli pull off because its not just hurting the Israeli startup ecosystem—it's dragging down returns for investors everywhere. (Photo by Hans Splinter). Crunch Network: CrunchBase the free database of technology companies, people, and investors |

| InternSHARE Blends Internship Postings With Ratings Posted: 28 Mar 2009 07:55 AM PDT

internSHARE is an all-in-one internship job and review portal where students can not only find a internship but also access the reviews of internships at companies, submitted by former interns. Internships can often be a hit or miss in terms of experience. Some companies merely make interns fetch coffee and make copies while others let interns step into the roll of a full-time junior employees. Regardless of how a company decides to handle its interns, it’s always helpful to know exactly what your role will be prior to the internship. The site’s reviews seem fairly comprehensive, offering overviews (provided by Wikipedia) and reviews of a range of companies including Research in Motion, IBM, and Amazon.com. The site also has a feature where existing interns can post descriptions about the interview process and give prospective interns tips about the interviews. Another cool feature is the ability to use Facebook Connect to integrate Facebook friends and features into internSHARE. internSHARE, which is student-run, recently merged with Coop.com, another Canadian-based internship database, boosting its users from to 8900 and creating over 2400 reviews for companies. Its seems that the site is slightly Canadian-centric. Most of the mid-size and smaller companies reviewed are Canadian based. And the job data base, whose listings are pretty paltry (there are currently only 6 internship listings, all in Canada), needs to be expanded in order for the site to really serve as a all-in-one solution to prospective interns. InternshipRatings provides a comprehensive database of U.S. internship reviews but doesn’t feature internship listings. InternshipIN and AfterCollege just offer internship listings. I think internSHARE has a good idea in trying to be a comprehensive database for students but needs to add internships in a variety of areas to appeal to U.S. students as well. And the site needs to offer more than 6 prospective jobs to college students.   Crunch Network: MobileCrunch Mobile Gadgets and Applications, Delivered Daily. |

| Dell Belatedly Buys Adamo.com Domain For Its Hot Notebook Posted: 28 Mar 2009 04:47 AM PDT

It’s not like they tried: the former owner of the domain name, Tucows subsidiary YummyNames, has no record of ever even being approached for a sale or lease of the internet address. Dell claims they had a broker contact the firm anonymously, who was quickly convinced the price would be too high (yet YummyNames leases domains from $750 per month). The computer manufacterer instead went with AdamoByDell.com but belatedly realized it wouldn’t be such a terrible idea to own or at least use Adamo.com too. Now they’ve finally made a move and acquired it outright for an undisclosed sum which was probably much higher than what they’d have paid a couple of weeks ago, according to Domain Name Wire. Both domain names now redirect to the product website. As DNW points out, Apple also purchased the iPhone.com domain name after launching the product, and there are many more historic examples of this. No doubt, companies will keep making mistakes like this in the future as well. Crunch Network: CrunchBoard because it’s time for you to find a new Job2.0 |

| TechCrunch Europe meetups - Saturday and Monday in San Fran Posted: 28 Mar 2009 01:59 AM PDT

The first involves a bunch of British and Irish firms on a co-ordinated attack on the Valley. WebMission09 involves 20 companies rattling around the Valley meeting investors and making contacts. TechCrunch Europe is co-hosting them tonight (Saturday) for the WebMission09 Cocktails @ Ozumo bar, adjacent to the Harbor Court Hotel in downtown SF. And on Monday night it’s an ad-hoc meetup in downtown SF just prior to Web2Expo. Logistics-wise we don’t have a venue for the meetup right now right now but it’s likely to be within striking distance of the Galleria Park Hotel on Sutter St. Sponsors of the bar are very welcome! To get an update on the venue for Monday, leave a comment on this post or follow Mike Butcher, TechCrunch Europe editor on Twitter, or follow the official WebMission09 hashtag of wm09 - you’ll find us. Crunch Network: MobileCrunch Mobile Gadgets and Applications, Delivered Daily. |

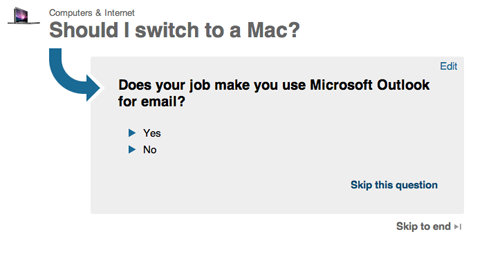

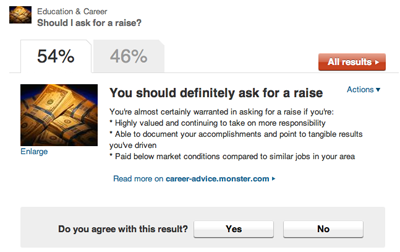

| Does Hunch Have All The Answers? We Take Flickr Founder’s New Startup For A Spin Posted: 27 Mar 2009 06:09 PM PDT Earlier today Flickr co-founder Caterina Fake announced the release of her latest startup, Hunch, in private beta. The site revolves around helping users make decisions spanning a wide array of topics. To help users make their decisions, Hunch presents them with a brief series of questions that have been submitted by other members, using their responses to help them make their ultimate decision. It’s a great idea that combines the crowd-sourced nature of Wikipedia with services like Yahoo Answers. But does it work? We’ve managed to get our hands on an invite to the service, and have put it to the test. From the start, it is clear that the site is very clean and unintimidating despite an already-large amount of data. Users are presented with a handful of featured topics on the homepage, most of which have been ‘played’ through many times before so they have complete sets of questions and answers. To the right of the page is a widget enticing users to anwer questions about themselves, which helps the system make more accurate judgements (the placement of the widget is clever - users are constantly invited to participate but aren’t forced to toil through a lengthy initial signup to ‘teach’ the system). And the questions used to analyze users are actually pretty fun (I was asked goofy questions such as “Do you believe in alien abductions” along with more conventional questions like “Where do you live”).  The bottom of the home page includes social features, including an activity feed and a listing of active users and members who are most similar (and dissimilar) to you. The site appears to employ a Twitter-like ‘follow’ system, so you can keep tabs on your favorite users. All in all the site looks slick, but does Hunch really have all the answers? At this point the site covers around 500 subjects, ranging from topics on computers and gadgets to relationships and dating. Some of the questions are just for amusement (which Star Wars character am I?), but most of them aspire to be genuinely helpful. After picking a question you’d like to have answered, the site presents a series of multiple choice questions (you always have the option to skip a question if you don’t know how to answer it). At the end, the system presents an answer, along with its next-best guesses ranked according to how confident it is with its decision. For example, say you were looking to decide between purchasing either a PC or a Mac. The site will present a series of structured questions set up by other users, such as “What do you intend to use the computer for?” In theory this is supposed to be better than asking the question on a general Q&A site like Yahoo Answers, because you won’t have to deal with the bitter flamewars that inevitably result. After entering ten questions or fewer, the system will spit out your answer.  The questions asked by Hunch, and ultimately the decisions it produces, are determined by user input. After ‘playing through’ each decision, users are asked if they don’t agree with the results, and can vote to change the way their answers were judged. Hunch also keeps track of which of the questions it asks have objective answers (”How much are you willing to pay?”) and which of them are more subjective, weighting each of these accordingly and taking the user’s personality profile into account. For those topics that are highly controversial (like the aforementioned Mac vs PC decision), Hunch also tracks items that are seeing a large amount of activity and can regulate them.  I ran through a number of trial questions, ranging from deciding if I should rent or buy a car to figuring out a good line to use on a date. For the most part I was impressed, though it quickly became clear that Hunch isn’t capable of magically making up your mind for you. After walking through questions I was often met with answers that were presented with around 55% certainty - not nearly enough to blindly follow Hunch’s guidance. Hunch would provide explanations for why it felt a certain option was best for me, but the fact of the matter is that decisions are rarely black and white, and there isn’t much Hunch can do about that. At this point I’m optimistic about Hunch - the site still has too few users to really be considered comprehensive, but many of the questions and resulting decisions I found were genuinely helpful. That said, Hunch is still going to be fighting an uphill battle: most people have been using resources like Wikipedia, Google, and Yahoo Answers to conduct research for years, and it’s going to be tough to break them out of the habit no matter how well Hunch works. Crunch Network: CrunchBase the free database of technology companies, people, and investors |

| Is Facebook Purposefully Lowballing Its Official User Numbers? Posted: 27 Mar 2009 06:08 PM PDT Facebook updates its official user numbers periodically on a statistics page that currently says 175 million users. They say that they update it every 25 million users, but many of us have long suspected that they may trail by much more than that. So how many users does Facebook really have? Check out this video (which we’ve clipped above), where Facebook developer Wei Zhu seems unsure how many users they’re allowed to say they have, until someone official steps in and corrects him with “200 million.” Zhu says Facebook has “250 or 60 million users,” then says “280.” At that point someone off frame says “200″ in an official voice, which Zhu then sticks to. But he doesn’t look like he’s happy about it. Comscore, which if anything tends to under report user numbers for most sites, says that Facebook had 276 million monthly visitors in February. Active users and monthly visitors aren’t the same thing, but they’re close, and with a closed site like Facebook, they should be very close. If Facebook has far more than 175 (or 200) million users, why aren’t they proudly announcing it? Perhaps because of all of the speculation on Facebook’s absurd growth over the last year. Specifically, all that growth is leading to outside analysis of Facebook’s costs, and when they might need more money. Conspiracy theory or a coverup to hide the true costs of running Facebook? You decide. Update: Zhu comments below, effectively neutering the coverup theory: Michael, I really just made a stupid mistake when I said "250-260 million users" instead of "150-160 million" :-). There is no conspiracy of any sort. I normally remember the number correctly, though. Oh wait. I was in the middle of a bad cold when I gave the talk and am still resting at home today. It must have been the cold. Wei Crunch Network: CrunchBoard because it’s time for you to find a new Job2.0 |

| Breaking: Former AOL Chief Jonathan Miller To Become News Corp.’s CEO Digital Media Posted: 27 Mar 2009 05:25 PM PDT

This is more than a little ironic. Miller currently works with Ross Levinsohn at Velocity Interactive Group - and Ross Levinsohn was the head of Fox Interactive before Peter Levinsohn took the position in late 2006. This means Miller is now running MySpace and other News Corp. digital assets, making him MySpace CEO Chris DeWolfe’s fifth boss in the last few years. Miller was under contractual obligations with AOL not to work with AOL competitors until this month. Time Warner vetoed his appointment to the Yahoo board of directors last year under the agreement. We and others have been speculating for weeks that Peter Levinsohn would soon be replaced (particularly since his champion, Peter Chernin, recently announced his own departure) along with a possible reorganization of FIM. Levinsohn is definitely out. What isn’t clear is how the division is being reorganized, but the job will almost certainly be bigger than running the existing FIM assets. Stay tuned. Crunch Network: CrunchBase the free database of technology companies, people, and investors |

| Facebook “Definitely” Raising Capital This Year; Google Considered Acquisition Posted: 27 Mar 2009 02:33 PM PDT

The company has been all over the place with on record comments about fundraising since that post. In November Founder Mark Zuckerberg firmly said “No” in response to the question “"Do you need money?" But in December Zuckerberg told me the company was open to raising more capital, but only at the previous $15 billion valuation:

Fast forward to last month, when Facebook board member Peter Thiel told BusinessWeek the company did not need to raise any more money and had sufficient cash to continue at its current growth rate. And then yesterday BusinessWeek reported that Facebook is looking to raise new debt capital to replace a $100 million line of credit. So Are They Raising Money Or Not? Yes, they are. eMarketer projects Facebook revenues of $230 million in 2009. Our sources say this is way low, and that Facebook will hit at least $300 million in 2009 revenues. But the costs of running this ginormous company are staggering. Facebook may be burning though $20 million or more per month, even on top of revenues. The problem with Facebook’s growth is that it’s all international, and those users just aren’t as profitable to the company (see our model from last summer). Our sources tell us that Facebook probably has around $300 million left in cash. If growth were to freeze at this point they’d have 15 months or so of runway. With their staggering growth rate, it may not last that long. We’re hearing they plan on raising money sometime this year to give themselves enough cushion to get to an IPO, or at the very least get through the economic downturn. Our sources say they’re pitching the company at a $10 billion valuation, but would be “thrilled” with a $5 billion valuation. Google Thinks Facebook Is Worth $2 Billion. We’ve also heard that there have been very low level conversations between Google and Facebook around an equity investment or outright acquisition. But these conversations never made it to the senior execs at Facebook. Perhaps because Google’s internal modeling may have valued Facebook at just $2 billion. There’s no way Facebook is going to take that valuation without a fight. So what will happen? Our guess is Facebook will take as much debt as they can to give themselves some breathing room. If revenue growth is as healthy as we’re hearing it is the company may be able to justify a higher valuation when they inevitably do take more equity funding. The big question is, what exactly will Facebook’s next valuation be? Update: A new source now tells us that Facebook’s internal revenue projections for 2009 are over $400 million, much of which is driven by the self serve ad system. We’re also getting confirmation on Facebook’s $300 million in current cash. Crunch Network: CrunchBase the free database of technology companies, people, and investors |

| OMG, OnStar May Soon Let You Twitter From Your Car Posted: 27 Mar 2009 02:25 PM PDT

All you Twitter addicts stuck in traffic, some good news. You might not have to risk your life any longer sending out one-handed Tweets on your Blackberry or iPhone, while trying to hide the fact that you are doing so under the dashboard. If you have OnStar in your car, you may soon be able to send and receive hands-free Tweets through OnStar’s voice-activated calling system. Andru Edwards at Gear Live discovered the potential feature. Your voice messages will be converted into text and sent to all of your Twitter followers. (Don’t worry if the translation is not perfect, everyone will think you are just using Twitter’s abbreviated style). It is not clear, however, whether or not the system tells you if you are over the 140-character limit. I can just see it now. Instead of listening to the radio, people will start listening to everyone they are following on Twitter (your Twitter stream can be read to you by the OnStar system). Then you are lost, and instead of using teh OnStar GPS, you ask your followers for directions. And they each give you a different way to go. This is definitely a sign of the Armageddon. Crunch Network: CrunchGear drool over the sexiest new gadgets and hardware. |

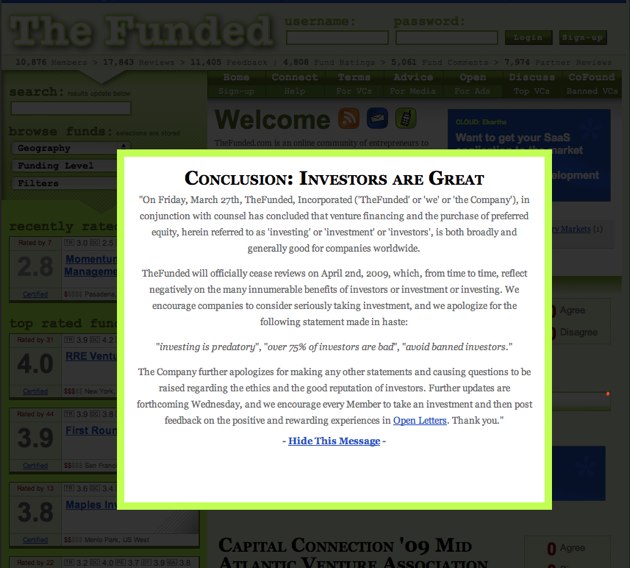

| Lawsuit Forces TheFunded To Shutter Service (or early April Fools joke) Posted: 27 Mar 2009 01:26 PM PDT

TheFunded, a website that rates venture funds based on first hand experiences from readers, is shutting down on April 2, according to a notice posted on the site today. This very well may be an April Fools joke, although founder Adeo Ressi has not returned our email requesting comment. The fact that the service isn’t shutting down immediately also suggests this is fake. The site has been controversial from the start, and many investors have never been pleased with TheFunded. Last August the company was involved in a lawsuit brought by a venture capitalist trying to track the identity of an anonymous commenter. TheFunded recently opened a new section of the site listing banned investors - that part of the site is no longer live. We’ll update when Ressi confirms its real or a joke. The last part of the message, below, is so rife with sarcasm that I’m leaning towards it being fake. The message:

Crunch Network: CrunchBoard because it’s time for you to find a new Job2.0 |

| Special YouTube Ads Earn Nonprofit $10,000 In A Single Day Posted: 27 Mar 2009 01:18 PM PDT Earlier this week YouTube launched a new feature for non-profit organizations called “Call to Action”, allowing these organizations to place special overlay ads on their videos free of charge. These overlays can direct viewers to the non-profits’ homepage, where users can elect to donate money, sign up for mailing lists, and interact with other members in the community. And unlike typical ads on YouTube (which video uploaders don’t generally have control over), non-profits can specifiy exactly which page they’d like to redirect to. To pilot test the feature, YouTube placed a video supporting charity:water on its homepage last Sunday, featuring an overlay encouraging YouTube users to donate money to the cause. In that one day, charity:water received a whopping $10,000 from YouTube viewers. Granted, the fact that the video was featured on the homepage clearly had a huge impact on the turnout, but the success of the new Call-to-Action ads is likely going to be a boon for many non-profits. Also worth noting is that this is another step in YouTube’s shift towards allowing major YouTube partners to place their own ads on the content they own (before now ads have typically been contextual and sold and served by YouTube). In January we reported that YouTube was quietly rolling the feature out to major content partners, and it wouldn’t be surprising if YouTube extends the powerful feature beyond brands and charities to start including celebrities and politicians, too.  Crunch Network: CrunchBase the free database of technology companies, people, and investors |

| Facebook COO Sandberg Joins Starbucks Board Of Directors Posted: 27 Mar 2009 01:08 PM PDT

Sandberg, who’s generally shy of press (she’s done just one video interview since she joined Facebook a year ago), is going to be getting a lot of credit in the future for driving revenue growth at Facebook. Prior to Facebook she was the VP Online Operations and Sales at Google and one of their first 300 employees. She was also previously with McKinsey & Company, the Chief of Staff for the United States Treasury Department under President Bill Clinton, and an economist with the World Bank where she worked on eradicating leprosy in India. And she’s not yet 40. The Starbucks job comes with a $280,000 annual salary. But, absurdly, the job doesn’t get her free coffee. Crunch Network: CrunchBoard because it’s time for you to find a new Job2.0 |

| RebelVox Makes Your Voicemail More Like Email Posted: 27 Mar 2009 01:03 PM PDT

RebelVox is a voice communications platform that aims to makes your voicemail function more like email. The technology is not yet available for consumers, but it will soon be shopped around to developers who may want to incorporate it in other apps. RebelVox’s technology will allow you to leave a voicemail for someone without actually making a call to the person. RebelVox’s mobile app will let you make a voice recording that is delivered as a message to your contact both through a mobile application and their email account. Your contact will be able to respond via another voicemail message, text message or email. You will be able to pick up a voice message from a friend while they are leaving it and speak to them live as well. RebelVox also has linking software built for the PC and Mac which will allow users to control the messages through their computer as well as their mobile phone. RebelVox’s technology can be woven seamlessly into most email accounts, including Gmail, Yahoo Mail, AOL and Outlook. Basically, RebelVox wants to let consumers interact with voicemail much like they would an email - something that badly needs to happen, because it its current form, voicemail needs to die. Currently packaged as software, RebelVox is still exploring how it wants to sell the licensed (and patented) software and how much it would like to sell it for. The company’s co-founder, Tom Katis, says that RebelVox is in talks with both mobile phone companies and third party mobile application. The service contains features similar to Google Voice, SpinVox, and PhoneTag, especially the ability to control the interface through your computer. RebelVox is certainly no replacement for Google Voice, but offers some features that could be a nice add-on, such as the ability to send voice messages without making a call. This video gives a comprehensive explanation of the technology and how it would work on a mobile device: The video shows the application being deployed on the iPhone, and it looks like it could be a really cool tool. It almost seems like it turns your phone into a walkie-talkie in some ways. Katis says that the software is ready to be deployed on any mobile device. The interface seems to work well on the larger screen of the iPhone but I’m not sure how user-friendly it would be on a smaller Blackberry or mobile device. Also, the concept of voice messaging isn’t new. Bubble Motion and Pinger are also allowing users use voice messaging over mobile devices. But Katis insists that RebelVox is different because it is a software, not an application, and it eliminates the wall between live conversations and messaging. Another company that lets users direct their calls straight to voicemail is SlyDial. Crunch Network: CrunchBase the free database of technology companies, people, and investors |

| The Sorry State Of Music Startups Posted: 27 Mar 2009 09:46 AM PDT

The labels don’t care if the startups make money, lose money or go out of business. All they want is to make enough money to extend the ultimate surrender date as long as possible. That’s when we’ll finally see the economic reality dictated by the Internet impose itself irrevocably on the music industry. Unless draconian laws are created and enforced that put people in jail, or worse, for file sharing. And even that probably won’t work. Anyway, these crazy economics are making the music startups skittish. MySpace Music, the biggest player in this space, may be spending $2 million or more per week to the music labels based on their own statistics that they’re streaming over a billion songs a week. Their streaming rate is likely to be the best in the industry, and it almost certainly isn’t lower than .4 cents per song. There is no way that they’re making that much in advertising revenue. The hope is that downloads, ticket sales, merchandise and ring tones will make up the difference, but what we’re hearing is that very little incremental revenue is being made from these other revenue sources. That means there’s no chance for these startups to work until the labels reduce, significantly, the streaming rates they’re charging. Or agree to radically different business models. There’s no sign that is happening any time soon. These crazy economics are making startups do odd things. I emailed one startup recently to suggest a post here on TechCrunch noting that they seem to be doing well - recent setbacks with partners didn’t hurt traffic as much as it may have, and I wanted to note that. The startup flat out asked me not to post, because they didn’t want positive press to impact their negotiations with labels. They had to present as desperate a situation as possible. Read that again: streaming music startups don’t want more people using their service, because they lose money from every one of them, and the perceived success from having more users makes it harder for them to plead with the labels to give them better deals. Then there’s imeem. A few days ago I had multiple conversations with the startup around rumors that they owed significant amounts of money to the labels that they couldn’t pay, and that they had failed to raise money or sell themselves. Not much information was shared, other than to say that the rumored $30 million owed to labels was too high. Now they tell VentureBeat that the number is in the single digit millions. Whatever the number - $30 million or $1 million - imeem can’t pay it. Their business model doesn’t work and it is going to continue to not work until the labels let it work. And they aren’t going to be doing that any time soon. Big Music Doesn’t Like Streaming Music The big music labels don’t like streaming music because it doesn’t help them offset declining CD sales, and the evidence now suggests that streaming doesn’t lead to music downloads. Everything we’re hearing says that the labels would like to see streaming music startups just go away for now so that they can focus on maximizing paid downloads and extend that ultimate surrender date. So when you hear about labels renegotiating streaming deals to help out music startups, be skeptical. They’re likely lowering the rates from 1 cent down to something closer to .4 cents per stream. And all that means is that these startups will bleed a little slower. But they’re still going to go out of business, because the venture firms are done investing in them. Crunch Network: CrunchBoard because it’s time for you to find a new Job2.0 |

| The $70 Million Obopay Deal Is More About The UnBanked Than The Banked Posted: 27 Mar 2009 09:43 AM PDT

When news came out earlier this week that mobile payments company Obopay raised another $70 million, effectively doubling its total funding raised to date, some observers were surprised at the sheer size of the round. While others expressed skepticism that mobile payments would ever really take off, at least in the U.S. But the bigger opportunity for Obopay and mobile payments in general is not in the U.S. It is in India and other parts of the world where a large portion of the population don’t have bank accounts. These are the so-called “unbanked.” There are billions of them and their relative spending power is on an upwards trajectory. Obopay CEO Carol Realini says:

And that is her strategy in a nutshell. Obopay operates in the U.S. and India right now. If you have a bank account, you can link it to Obopay and use your phone to make payments wherever Mastercard is accepted. If you don’t, you can load up your account using a prepaid model. Realini throws out some Gartner estimates that only 6 million people use mobile payments today across the entire world, but that could grow to 100 million by 2011. (Add salt, nobody really knows). Despite Obopay’s two-pronged strategy, if mobile payments do take hold, I’d expect them to be more popular among the unbanked outside the U.S. Most people in richer nations already have an abundance of payment options available to them, and adding a mobile wallet won’t make a huge difference one way or another for most people. In countries where payment options are more limited, the ability to turn your mobile phone into a wallet should be much more appealing. Obopay is not alone in trying to bring mobile payments to India. Other startups such as Australia’s Paymate and India’s own mCheck are also making inroads. But that $70 million should help Obopay establish a presence there. One more thing about that money. Many of the reports suggested that the entire $70 million came from Nokia, which is wrong. Realini confirmed to me that “there are other investors.” Although she says she is not at liberty to disclose who they are at this time. One place to look is the long list of investors who have poured money into the company in the past. Qualcomm, Redpoint Ventures, Onset Ventures, and Richmond Management seem to be the company’s steadiest investors across previous multiple rounds—although I have not confirmed their participation in this one. Crunch Network: MobileCrunch Mobile Gadgets and Applications, Delivered Daily. |

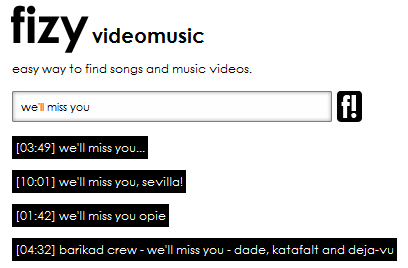

| Fizy Is The Speedy Gonzalez Of Music Search Posted: 27 Mar 2009 09:15 AM PDT

It’ll even display an associated video if it can detect one, and you can easily share songs - which come with dedicated URLs - on a wide variety of social networking services. That’s about all it does and it does that pretty well; I was even able to find songs from one of my favorite bands, Blackbox Revelation, which is not always the case with these types of new services. Fizy claims it can pull up about 75 billion MP3s thanks to access to over 50 different APIs, and the speed is probably the most amazing thing about it and also the main differentiator compared to the plethora of similar services. Bonus points for setting up the service with an international audience in mind: Fizy supports nearly 30 languages to date. It’s completely web-based, it’s gorgeously limited in features, slick and superfast. That makes it as addictive as it is illegal, and that’s why I’ll be missing it when it’s gone. That could take some time, since there’s no address or name mentioned anywhere on the site, although a quick WHOIS lookup points in the direction of Turkish company beril tech. Update: Fizy was acquired a month ago, by Site A.Ş, a member of Z Group, also the group behind Turkish online advertising agency ReklamZ. In the meantime, thank you for the music! Crunch Network: MobileCrunch Mobile Gadgets and Applications, Delivered Daily. |

| You are subscribed to email updates from TechCrunch To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Inbox too full? | |

| If you prefer to unsubscribe via postal mail, write to: TechCrunch, c/o Google, 20 W Kinzie, Chicago IL USA 60610 | |

Last week, a blog post

Last week, a blog post  Everyone knows there are plenty of Europeans already in Silicon Valley, but

Everyone knows there are plenty of Europeans already in Silicon Valley, but

Last October we wrote about how Facebook’s breakaway growth combined with a declining advertising market was

Last October we wrote about how Facebook’s breakaway growth combined with a declining advertising market was

Online streaming music startups are in one very sorry place. On demand streaming rates range from .4 cents to 1 cent per stream - this is what the startups pay to the labels every time they play a song for a user. Add bandwidth and storage costs on top of that, which aren’t trivial for services that want to stream music quickly on demand. The result is hundreds of millions of dollars flowing from venture funds to startups to labels. Little of it makes its way to artists, and advertising revenues only cover a tiny portion of the fees.

Online streaming music startups are in one very sorry place. On demand streaming rates range from .4 cents to 1 cent per stream - this is what the startups pay to the labels every time they play a song for a user. Add bandwidth and storage costs on top of that, which aren’t trivial for services that want to stream music quickly on demand. The result is hundreds of millions of dollars flowing from venture funds to startups to labels. Little of it makes its way to artists, and advertising revenues only cover a tiny portion of the fees.

Check it out before it gets blown off the interwebs:

Check it out before it gets blown off the interwebs:

No comments:

Post a Comment