The Latest from TechCrunch |  |

| Posted: 26 Mar 2009 08:01 AM PDT

Attendees will enjoy an action-packed agenda, including pitches, panels, working breakfasts, lunch sessions, and after-parties at the beautiful San Francisco Design Center Concourse, with 125,000 square feet of networking space. As in previous years, launching startups will pay nothing to attend or present. One company will win $50,000 from the TechCrunch50 organizers. This year, we'll have an Audience Choice Award and other recognitions too. We’ll be providing a lot more information over the coming weeks and months, but here’s what you need to know now: We’re putting a limited number of very early bird tickets on sale now for $995. Tickets will eventually be priced at $2,995, so buy them now if you know you are attending and get a great deal. We also have special pricing for students. If you want to be one of the fifty presenting startups, you can apply starting now. We review applications on a rolling basis and are ready to extend offers for participation immediately. Please submit your company whenever you are ready for consideration. The final deadline is June 30. Finalist companies will remain stealth until the conference, launch to the public on stage and receive feedback from our panel of industry experts. Our 2007 and 2008 advisors are an important part of our success. We’ll be announcing this year’s panel of experts in the coming months.

Great partners make great conferences We’re really lucky to have the corporate support of some of the best names in the business. Sequoia Capital, Charles River Ventures and Perkins Coie all returned quickly to support us for the third year in a row. Google, Founders Fund, Microsoft and MySpace are back for their second year of partnership. Additional partners will be named in the months leading up to the conference.

Crunch Network: CrunchBoard because it’s time for you to find a new Job2.0 |

| Triple Deadpool: FileFront, Cruxy, Documentary-film.net Posted: 26 Mar 2009 07:40 AM PDT

Busy day for the deadpool. Earlier today we had to drag a startup out of there, and now three others are tumbling into it (although one might still be saved in time). Here’s a quick overview: - Ziff Davis property and popular game-centric file download service FileFront is closing down on March 30 due to the “current economic conditions” and this after 10 years in operation. Users have only a couple of days left to retrieve their files before the website is indefinitely suspended. - Cruxy, a nearly 5-year old provider of marketing, monetization and analytics tools for digital creators ranging from film makers to music artists, is calling it quits too. Its founders claim to be ‘exhausted’ and admit that the service just didn’t get enough traction to justify keeping it alive. They’re pulling the plug on April 1. - If you’re a fan of documentaries, this is bad news for you: Documentary-film.net, an under-the-radar quality video documentary hosting service with a small but loyal fan base, is unable to cough up the necessary money for decent hosting infrastructure. The website has long been among the top results when searching for ‘documentaries’ and ‘documentary’, so I’m convinced someone out there recognizes the value of it. We’re deadpooling it, but it still has a shot. By the way, the farewell messages from the latter two victims of the recession give you a good insight on what it’s like bootstrapping a labour of love service and then being forced to shut it down, so consider it recommended reading for aspiring entrepreneurs. Crunch Network: CrunchBoard because it’s time for you to find a new Job2.0 |

| More Security Loopholes Found In Google Docs Posted: 26 Mar 2009 05:55 AM PDT

Since he did the right thing by contacting Google about his findings (only to receive no response after five business days), we’re hoping that this article will help trigger the company’s engineering team to plug the holes asap. In case you missed it, earlier this month we uncovered some major privacy blunders going on with Google Docs, which the company later confirmed and fixed (we pinged them for this too). So what’s up? First, apparently when you embed an image in a protected document it gets uploaded to a Google server where people you’ve not given access to the file can still see and download it, even after you’ve deleted the document in question. I’ve uploaded an image to a protected file in my account for testing, and deleted the document right after. If you see the image embedded on top of this post, or click this link to find you can still get to the image, that means the above checks out. I concur with Barkah, who writes:

Images can potentially contain confidential information, both personally and professionally, and it basically only takes finding out what the dedicated URL for an image is for anyone to access it freely, which is a massive privacy blunder. Second, it appears that if you share a document carrying a diagram - a feature Google introduced yesterday - with anyone, this person will be able to view any version of any diagram that has been embedded in the document. That basically means that if you create a diagram with sensitive information and later decide to strip some of it away before sharing the document in view-only mode, the person you share it with will be able to revert to previously saved versions simply by tweaking the URL a bit, uncovering what you thought you were still hiding from him or her. The third issue Barkah lays out is such a serious bug that he doesn’t go into the details of the mechanics behind it yet, pending further research and feedback from Google. The security specialist claims that if you take away the permission for another person to access your documents, they could in some cases still be able to get to them later without your knowledge. If that last claim turns out to be valid, I’m leaving Google Docs and never coming back. Crunch Network: CrunchBoard because it’s time for you to find a new Job2.0 |

| Europeans still shopping as Russia’s KupiVIP raises another $8m Posted: 26 Mar 2009 05:54 AM PDT

Crunch Network: CrunchGear drool over the sexiest new gadgets and hardware. |

| Mystery PE Fund Throws A Lifeline To Niche Social Network Sneakerplay Posted: 26 Mar 2009 03:52 AM PDT

The fund, dubbed Keroch, has acquired the assets and IP of Sneakerplay and plans to grow the niche community site to a more relevant property. The terms of the deal were not disclosed, but Sneakerplay has always been a completely bootstrapped venture so we can safely assume the founders are happy with the sale, especially since they’ve basically moved on from the project some time ago. What struck me is the fact that everyone seems to be doing their best to conceal the names of the people involved with the private equity fund. The website won’t teach you a thing about that, except for the tidbit that the team consists of four partners, who “possess 30+ years of combined experience in the technology/internet industry ranging from large companies such as Yahoo! to small start-ups.”. The only name we came up with so far is Brian Rothenberg, former product manager for Yahoo! Real Estate. Either way, the acquisition of Sneakerplay is Keroch’s first move and they plan to turn the small community of sneakerheads into a relevant niche social network with more features and a clear path to monetization through sponsorships and on-site advertising on the roadmap. As an aside, some people were upset when I deadpooled the company (and now of course I happily admit they were right) but it seems like the article at least got the Sneakerplay team the necessary attention to engage in bidding wars with potential acquirers. Co-founder Robleh Jama has promised a post on his personal blog with all of the juicy details from dealing with investment bankers, to press coverage, bidding wars and exploding term sheets, which should be an interesting read. Crunch Network: MobileCrunch Mobile Gadgets and Applications, Delivered Daily. |

| Visible Measures Raises $10 Million Series C Funding To Track Online Videos Posted: 25 Mar 2009 10:27 PM PDT Viral video tracking and measurement firm Visible Measures has closed a $10 million series C round of funding, led by Northgate Capital. Existing investors Mohr Davidow and General Catalyst also participated, bringing the total capital the company has raised since launch to $29 million. The last time it raised money was in January, 2008. Visible Measures lets both ad agencies and big video publishing sites on the Web track viewership and engagement with videos across the Web. Ad agencies can measure the effectiveness of specific video ad campaigns, and publishers can see which of their videos are being played and passed around the most. The company is currently tracking more than 200 million different online videos and video ads. Each day it measures the equivalent of 100 years worth of collective online video viewing consumption. It is trying to bring the types of metrics normally associated with direct response ads to brand awareness. Crunch Network: CrunchGear drool over the sexiest new gadgets and hardware. |

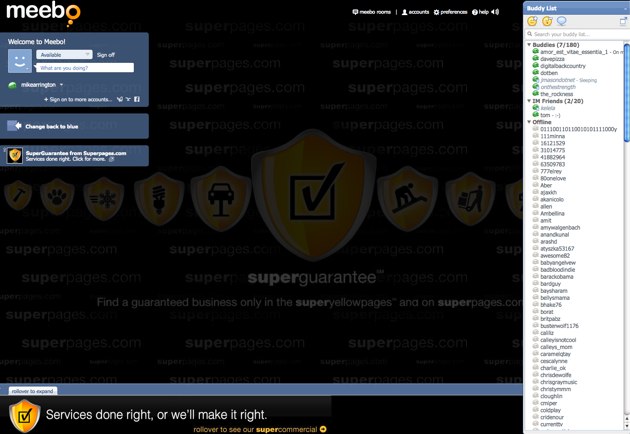

| Meebo Turns Into One Big Ad, But Users Seem To Like It Posted: 25 Mar 2009 09:40 PM PDT

Web chat service Meebo, always innovative with advertising, is trying out something fairly aggressive: full takeover ads that show a persistent advertisement in the background. The company says that they already got 1% or higher click throughs on existing ads units on the site, which included rollovers at the bottom of the screen and another unit right in the middle. But the new units actually take over the entire background of the site, meaning users are literally slammed with the messaging. They are presented with an option of removing the add with a click. And the users don’t seem to mind at all. Founder/CEO Seth Sternberg wrote a blog post today on the new ads and asked for user feedback. Most of the 100+ comments to the post are very positive. Example comments: “Awesome…Black is a really nice look for Meebo…The ad is really subtle, too — not all up in your face…"Did we strike a good balance between not disturbing your use of Meebo, while acknowledging the need to run ads?"…Hell to the yes!” “I think this is a brilliant way to put ads up without being obtrusive and annoying. No one likes banner ads or popups. This does look like a good balance. I hate ads as much as the next guy, but know the need for them to support your business, and the fact that you concidered your clientell in your design means a lot. It means my willingness not to click the 'backtoblue' button and get rid of it because it simply being there and me not clicking is paying you for a job well done.” YouTube, ESPN, MySpace and others have tried similar ads in the past, and these things command great fees. If Meebo really has gotten the users to buy into this, we may be seeing similar stuff all over the place, and soon. Crunch Network: CrunchBoard because it’s time for you to find a new Job2.0 |

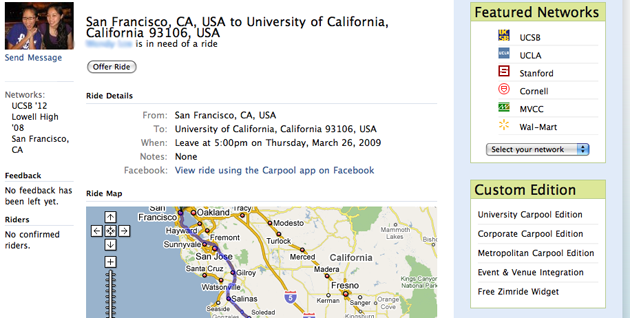

| Zimride: A Carpooling Startup That Actually Makes Money Posted: 25 Mar 2009 08:24 PM PDT Zimride - a startup with a tagline that reads “A Carpool Community” - sounds exactly like the sort of benevolent Web 2.0 service that will never make a cent. As it turns out, since launching in 2007 and winning fbFund last summer, the company has managed to carve out a nice niche for itself that saves its users money, helps the environment, and actually manages to generate revenue. And, unlike some of its carpooling competitors, it has also managed to avoid getting sued by Canada. Zimride offers an application on Facebook Platform, inviting users on the same network to meet eachother and share a car trip. Users can also visit the service on its website at Zimride.com and find trusted users through Facebook Connect. After entering their current location and their destination, Zimride will generate a list of potential matches arranged by how far out of the way each one wants to travel. Users can also post a destination they’d like to travel to some time down the line, and receive alerts through Email when a match pops up.

The service is offered for free for up to 50 members per school or company network, but once it crosses that threshold Zimride seeks out the network owner and asks them to pay a subscription fee if it wants to continue allowing its students or employees to use the service. While this sounds a bit risky (Zimride stands a chance at pissing off students if their school decides not to join), COO John Zimmer says that institutions have generally been very receptive to the idea. The company works with transporation departments and student governments at universities and large companies, and charges universities $9500 a year for the service (they can pay month-to-month). So far, the company has managed to sign up 20 instutitions, including Stanford which has seen over 14,00 new users share 300 rides in three weeks. And aside from earning money as a carpooling company (which is impressive in itself), Zimride is also notable for being a Facebook application that generates revenue through something other than advertising. Crunch Network: CrunchBoard because it’s time for you to find a new Job2.0 |

| Mortgage Recommender Home-Account Secures $1 Million In Seed Funding Posted: 25 Mar 2009 07:21 PM PDT

Home-Account, a recently launched mortgage search and counseling service, has secured $1 million in seed and angel funding. The largest investor is Charles River Ventures, which gave the startup $300,000 through its QuickStart Seed Funding Program (the program usually only gives startups $250,000 but saw promise in Home-Account). Additional investors include many well-known Silicon Valley entrepreneurs and investors: Marc Benioff, Ron Conway, Mark Pincus, Jeff Clavier, Arjun Gupta, and Gigi Brisson. Home-Account offers a compelling service for those who are looking for mortgage or to re-finance. In the current economy where credit is difficult to access, Home-Account helps consumers find the right mortgage for their needs and credit histories. Here’s how it works. Consumers fill out a free online mortgage profile to determine if their credit history qualifies them for a mortgage and what interest rates they could qualify for. Once Home-Account determines that a consumer qualifies for a mortgage, the startup will get mortgage offers from its partner lenders (this service costs users $10 per month). With credit standards tightening for mortgages, many consumers may not qualify for a mortgage in the current climate. Home-Account offers a second service (also $10 per month) which will help consumers with poor credit history improve their credit scores and get their financial history in order to become more desirable applicants for mortgage lenders. CEO Mark Goldstein says that he wants Home-Account to be the Kayak.com of mortgages. He says that Home-Account creates a better, more transparent way to get a mortgage. A good mortgage broker should do a lot of hand holding, says Goldstein, and recently, mortgage brokers haven’t been doing their jobs correctly. Home-Account doesn’t make commissions from the buyers or the lenders, like some online mortgage services like LendingTree.com and LowerMyBills.com. It makes money solely from the consumer subscriptions. Goldstein formerly co-founded BlueLight.com, which was Kmart’s foray into e-commerce during the first dotcom bubble. The Home-Account team is partly made up of mortgage technology experts from Washington Mutual. Since the startup’s launch, 25,000 consumers have used the mortgage evaluator and several hundred have signed up for the paid mortgage finder service. For a subscription service, however, there is sure to be a lot of turnover. Once a consumer finds a mortgage, they won’t need the service anymore. Only people with the worst credit will have any incentive to keep their subscriptions going, and Home-Account will have the perverse economic incentive of keeping their hope alive as long as possible.  Crunch Network: CrunchBase the free database of technology companies, people, and investors |

| Apple’s iPhone App Refund Policies Could Bankrupt Developers Posted: 25 Mar 2009 06:17 PM PDT

We reported yesterday about Apple’s alleged delay in payments to iPhone app developers, but there is more alarming news from iPhone developers about Apple’s refund policies. Apparently, if iPhone users decide that they want a refund for an app (users can get a refund within 90 days, according to Apple policy), Apple requires that developers give back the money they received from the sale. But here’s the kicker—Apple will refund the full amount to the user and says that it has the right to keep its commission. So the developer not only has to return the money for the sale, but also has to reimburse Apple for its commission. Apple charges a 30% commission on all paid apps sold through the App Store. So basically, developers get 70% of a given sale but if the end-user wants a refund, the developer has to pay Apple 100% of the sale. Here’s the clause in the contract:

The developer we spoke to seemed to think that the app would become unusable if a consumer gets a refund for a particular application, but the developer was unclear if this actually happens. We were also told that this section of the contract is new, and developers are being forced to sign this in order to sell apps in the next generation App Store (for when the iPhone OS 3.0 is officially released). But we saw a contract from another iPhone developer who signed the agreement back in December and the same clause was part of the contract. We are assuming that Apple still has to pay bank fees on a charge if a consumer wants a refund, but certainly bank charges don’t amount to 30 percent. This policy still seems incredibly unfair to developers. Apple should instead require developers to return the exact amount they received from a refunded sale, not extra. Apple has a ton of money in the bank and could stand to make a lot more from the app store down the line as the iPhone user base grows. With these fees, Apple is pointing a big red arrow at why developers shouldn’t be developing for the iPhone—namely, they’re at the mercy of Apple, which is making a habit of treating its developers like dirt. Here’s a copy of the actual contract:

Crunch Network: CrunchBoard because it’s time for you to find a new Job2.0 |

| Troubles At Imeem, But Company Says No Shutdown Imminent Posted: 25 Mar 2009 05:48 PM PDT

Music insiders are saying a shutdown of the company is imminent after a failed attempt to sell the company or raise more cash. A spokesperson flatly denied the shutdown rumors today, but confirmed that the company layed off staff last week (six people from a staff of around 70). He wouldn’t comment on funding or sale rumors, although plenty of potential buyers tell us they’ve been pitched to buy the company over the last year. The “problem” with Imeem, like all streaming music services, is that they have to pay a flat rate per stream to the music labels that’s hard to cover with advertising alone. Some companies pay as much as $0.01 per stream, which doesn’t seem like a lot - but at volume it’s crushing, particularly in a down advertising market. One source tells us that Imeem owes the labels as much as $30 million to date with no hope of paying any of it. Imeem says that is “extremely innacurate,” but confirms that they are playing “in excess of a billion songs and videos per month.” Online music is a tricky business, where rabid users can actually quickly put you out of business simply by listening to too much music. Imeem says they’re refocusing their efforts on additional revenue streams, such as paid downloads, tickets and ring tones. One new feature allows users to download entire playlists for a fee with the click of the button, which is sure to be popular. The big question is whether that will be enough to make the business even remotely profitable. This is one tough company that has reinvented itself more than once to find a way to profitability and success. I wouldn’t necessarily bet against them. But the clock is ticking on this startup. Crunch Network: MobileCrunch Mobile Gadgets and Applications, Delivered Daily. |

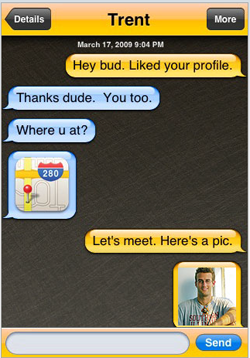

| Gay Dating Makes Its Way To The iPhone Posted: 25 Mar 2009 05:47 PM PDT

The iPhone is a hotbed for location-based social networks, which tap into the phone’s geolocation features to help users find nearby friends and strangers that they might like to meet. We’ve seen a handful of dating applications that cater to the straight community, and today brings the launch of Grindr (iTunes Link), one of the first iPhone applications geared towards gay and bisexual men. While privacy is an issue for all location based social networks, it is of the utmost importance on gay networks. Without proper security measures, bigots could easily download such applications and use them to pinpoint targets for hateful slurs and potentially even violence. Grindr deals with these issues by obscuring a user’s absolute location by default. Rather than plotting each user on the map. Grindr displays how far away they are (distances can range from a few feet to miles away). The application presents users with a list of nearby strangers, arranged in a grid of photos (you can click on a photo to see their personal profile). From here, users can strike up a real-time chat. If they decide they like their new acquaintance, they can they optionally choose to reveal their exact location. One of my concerns with new iPhone-based dating networks like Skout is they they have to face off with huge, well established players like Match.com, which are slowly releasing their own iPhone applications. Grindr’s Joel Simkhai says that there are a number of well established dating sites for gay men, but says that many of them feature adult content which Apple likely will be opposed to, giving Grindr a better shot. Other gay dating apps on the iPhone include The Gay Community App, which appears to have been hampered by a number of bugs that were recently fixed in an update. Crunch Network: CrunchGear drool over the sexiest new gadgets and hardware. |

| Want A Free, Cheesy Wedding Planned By Millions Of Strangers? Head to MySpace. Posted: 25 Mar 2009 03:06 PM PDT

If you have ever wanted a cheesy, media-sponsored wedding like those on reality TV shows or on the Today Show, perhaps you should look to your social network. MySpace is now accepting submissions for "Married on MySpace," an online reality TV series that will let couples receive the “wedding of their dreams” planned by and shared with the entire social network . Engaged couples can enter their video submissions here. MySpace is partnering with The Knot to provide editorial content and wedding planning expertise and the contest is co-sponsored by Disney, who is releasing “The Proposal” soon with Sandra Bullock and Ryan Reynolds. And MySpace is partnering with Endemol, a European reality television production company that has created classy reality tv shows like FearFactor, Extreme Makeover and Big Brother. After submissions have ended, MySpace members can chose their favorite couples from a group of finalists. Once a finalist has been selected, members will continue to vote on elements of the wedding, including what the bride and groom will wear, where the couple will celebrate their bachelor and bachelorette parties, the wedding location, and more. The series will debut on MySpace in May with the announcement of the chosen couple and conclude in early August with the wedding ceremony. “Married on MySpace” will consist of 13 webisodes that document the wedding planning process the same way that wedding reality shows like “Whose Wedding Is It Anyway” profile weddings. I have no doubt that MySpace will be able to enlist plenty of attention-hungry couples who want their few moments of reality web TV fame. And it certainly doesn’t hurt that News Corp. will foot the bill for your wedding. I’m just curious as to how many MySpace executives would allow the social network’s millions of members to plan their dream weddings. Here’s the publicity video for the series: Crunch Network: CrunchBase the free database of technology companies, people, and investors |

| Atlanta Gets Its Own Y Combinator In Shotput Ventures Posted: 25 Mar 2009 02:35 PM PDT

Silicon Valley has Y Combinator. Boulder, Colorado (and now Boston) has TechStars. Boston also as of today has Start@Spark. Washington, D.C. has LaunchBox Digital. Philadelphia has DreamIT Ventures. And now Atlanta is joining the seed incubator movement with Shotput Ventures. Started by a group of Atlanta tech entrepreneurs who want to attract and keep startup talent in the Southeast, Shotput Ventures is accepting applications from young, first-time founders for its summer program. The deadline is April 10. Mitch Free, the founder of industrial marketplace MFG.com, is one of the backers. He explains in an email: We are looking for “capital light” web startups. We think there is so much open source software, web services and cheap cloud computing capacity (like Amazon S3) that web business can be prototyped and launched very inexpensively. Ideally we are looking for a small team of co-founders, most likely still in college. We will pick 8 to 10 teams and give them $25k each so they don’t have to get summer jobs and can work on the product full time. We (all seasoned entrepreneurs) will mentor them through the summer. We will take a 5% to 10% equity stake. At the end of the summer we will pick some to further fund and/or help raise capital and some we will probably kill. There has been nothing like this in the Southeast. We have lots of great breeding grounds such as Georgia Tech but the people with the next big idea have had to reach out to the Northeast or West Coast to find seed capital and support. Our goal is to create an eco-system in the Southeast to encourage and support web startups. And once they are up and running we don’t want them having to relocate to Boston or San Jose The first summer round is funded with $300,000. Who needs a summer job, when you can create a startup instead? Crunch Network: CrunchGear drool over the sexiest new gadgets and hardware. |

| Pet Airways: Forget Cargo, Your Pet Needs To Fly First Class Posted: 25 Mar 2009 01:54 PM PDT

If you are rich enough you can bring them on your own private jet. Another trick is to have your animal certified as a “service animal,” (you can even do this online) and I hear you can then take them just about anywhere. It’s a loophole that is sure to be plugged once too many people take advantage of it. Enter Pet Airways, a new startup launching next month that flies pets and only pets: “With Pet Airways your pet will be safe and comfortable, flying in the main cabin, not in cargo. From check-in at our Pet Lounge, and throughout the flight, our Pet Attendants will be caring and catering to all your pet’s needs. You can even monitor how your pet is doing.” Fees start at $150. Sadly, only your pet can fly, not you (they won’t even put you in the cargo area of the plane). Flights will be limited to start, basically from Los Angeles to the East coast with stops in Denver and Chicago. The company says they’re funded but aren’t giving details yet. Each flight has a pet attendant on board at all times, and the airline will start with a fleet of twenty planes, ranging from twin props to 727s. I have no idea if this airline is going to be a commercial success, but I’m hopeful. If they start flying from San Francisco to Seattle, Laguna will be a regular customer. And I’d pay a lot more than $150. Crunch Network: CrunchGear drool over the sexiest new gadgets and hardware. |

| Justin.TV Is Bigger Than Hulu . . . Overseas Posted: 25 Mar 2009 12:02 PM PDT

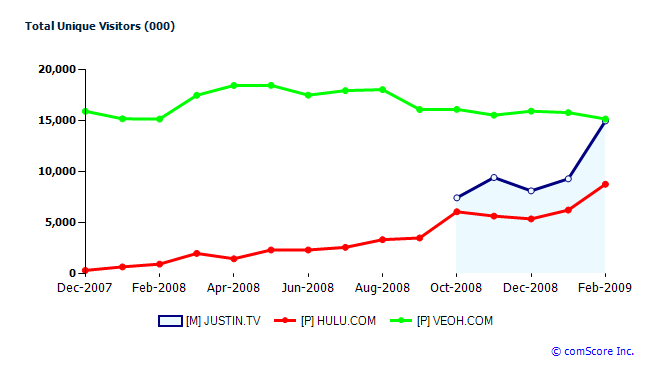

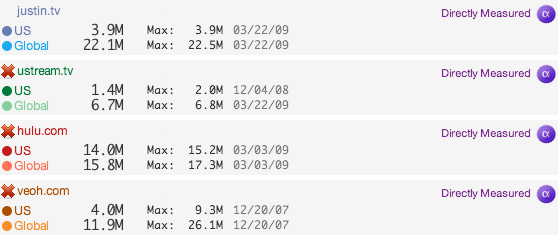

Live video on the Web is starting to take off, judging by the massive jump in traffic that Justin.tv is witnessing. According to comScore, the live video site’s global audience saw a massive jump from 9.3 million unique visitors in January to 15 million in February, which is about the same number of people who went to Veoh and nearly twice as many as visited Hulu.com. Of course, Hulu is only available in the U.S., where it is fourth most popular video site, and its videos are watched on other sites as well. In the U.S., ComScore only shows Justin.tv attracting 1.4 million people in February. So most of its audience and growth is global, with particular strength in Spain, Brazil, Germany, and the UK. Quantcast, which directly measures all three sites, shows a similar trend. Globally, Justin.tv has 22.1 million monthly uniques, compared to 15.8 million for Hulu, and 11.9 million for Veoh. While the U.S. numbers are 3.9 million for Justin.tv, 14 million for Hulu, and 4 million for Veoh. (Ustream.tv seems to be the second-largest live video streaming site with 6.7 million global monthly visitors and 1.4 million in the U.S.). These are all site numbers, Quantcast also measures “network” numbers which presumably includes videos embedded elsewhere, and those are about double the site stats for each service. Justin.tv itself claims 1,800 percent year-over-year growth in unique visitors based on its internal Google Analytics numbers.

What all of these number show is that live video is beginning to make its mark, and could soon challenge the top video sites for the attention of audiences. There are 428,000 channels broadcasting live video on Justin.tv. Of those, 40,000 channels broadcast 1.75 million hours of video each day. And the level of engagement seems to be just as high as on regular video sites. ComScore’s VideoMetrix estimates that the average Justin.tv viewer in ethe US. watches just over an hour a month (64.7 minutes), almost exactly the same as a Veoh viewer (64.5 minutes), but still well below a Hulu viewer (87.2 minutes). So why is Justin.tv so popular overseas? Could it be all the live sports events streamed over the service? Soccer and female wrestling seem to be particulraly popular. Crunch Network: MobileCrunch Mobile Gadgets and Applications, Delivered Daily. |

| Now that China Is the New Israel…What’s Israel? Posted: 25 Mar 2009 09:47 AM PDT

The rapid pace of liquidity in the late 1990s meant Valley investors couldn't find enough start-ups to stuff their money into, and unlike dot com fluffiness that was roaming around San Francisco, Israelis were hard-core techies with a work ethic that seemed to defy basic human needs like sleeping and eating. Most of all, Israelis, particularly those in high-tech and cosmopolitan Tel Aviv, had a reputation for living like there was no tomorrow, because when you're surrounded by hostile neighbors there may not be. The 1990s were a period of a lot of structural change in the venture business. It was no longer about families and private money investing—money came from big public pension funds and endowments, and more of it was coming online as the baby boomer retirement accounts swelled and the American stock market made everyone richer. That kind of scale forever changed the venture game. Meanwhile, the Internet enabled companies to be flipped in under two years—also unheard of before. Similarly, Israel represented one of the first times the cozy boutique Sand Hill Road firms ventured overseas and made money as a result. For a time, Israel had more Nasdaq-listed companies than any other country in the world. Then the crash, happened here and there. Only Israel got a double whammy of the Second Intifada and a resurgence of violence starting around the same time. The talk was always that Israel would come back as a hub for brilliant, crazy, ballsy entrepreneurs, and the returns would come back too. Weren't these things just cyclical? A positive sign was how many Israeli VC firms were opening their doors. For much of the last ten years, investments in Israeli companies by Israeli VC firms has roughly equaled foreign investment in Israel, according to stats from Ben Gurion University’s School of Management. That’s a huge strength, as Valley and Boston investors always like to invest with local partners, and a lot of developing economies don’t yet have that local infrastructure. By 2004, an executive from Silicon Valley Bank was quoted in the San Francisco Chronicle after leading a contingent of VCs back to the Holy Land saying Israel was poised to explode again. He crowed that the crash and violence aside, Israel was getting more venture money than anywhere other than Silicon Valley and Boston and it was only ramping up. But it turned out, he was wrong. Money continued to invest along the same $1.2 billion-to-$1.4 billion a year range, and returns fell off a cliff. Israeli companies have raised just over $10 billion since the beginning 2001, but acquisitions and IPOs have returned just over $860 million over that almost eight-and-a-half-year period. Bear in mind, the industry tends to measure performance over ten-year periods, and not many people expect a roaring acquisition or IPO market for the rest of 2009, and arguably 2010. Compare those numbers to start-ups in Europe, a continent that has long been characterized as risk-adverse, thanks in part to labor laws that work against start-ups. Sure, Europe is a bigger place, so its to be expected that European companies have raised a much bigger 36 billion in Euros since the beginning of 2001. But European companies have returned $6.3 billion. If you do the percentages, Israeli companies have returned 8.6% of the money invested over the last eight-plus years. I don’t know how to account for Euro-to-Dollar conversation rates over eight years’ time, so let’s pretend for a moment that it was 36 billion in dollars invested in Europe. If that were the case, European companies would have returned 17.5% of the capital invested. The real percentage is undoubtedly much higher, although still pretty poor as an industry. Most investors like to get all their money back, and then some. (All stats are from Dow Jones VentureSource.) Ten years after the peak of the last bubble, it's clear that when foreign investment fell in Israel from about $4 billion a year to $1 billion a year, the country wasn't just weathering a recession. Somewhere along the way, the entrepreneur scene here lost its mojo. Now, before the hate mail starts, let me be clear, that numbers aside, I still believe Israelis are singular entrepreneurs. There is interesting stuff here and always will be. There's an element of risk taking that even the Valley can't rival, and it's no secret Israelis are brilliant technologists. They also share a lot of qualities with some of the best entrepreneurs I know: They're born hackers. They love to work within constraints to make something happen. They love when odds are stacked against them. They're ballsy. They're brash. As I said in this interview with Loren Feldman yesterday, they start companies like they drive. In either case—you don't want to be in their way. So I don't say this to trash Israel, but facts are facts. In sheer numbers, Israel’s place on the global scale of investing has been dwarfed by China, and matched by the United Kingdom. And after three days of talking to dozens of entrepreneurs and investors in Tel Aviv, this seems like a country wandering in the desert, looking for a new tech movement to own and dominate. What happened to Israel is a bit like what happened to Boston—the story and opportunity moved away from what the city's entrepreneurs were good at. In the case of Israel, security and encryption was always a strength, but that's not the growth industry that it was. In the case of Boston, enterprise technologies and telecom were always strengths. Now, as media has become the story of the last boom, it's not a surprise New York surpassed Boston in the amount of venture capital raised. Internationally, China has become the new obsession, with India a close second. It's not that Chinese entrepreneurs are better than Israeli entrepreneurs. And so far, there are certainly a lot of concerns about returns in China. But when it comes to international entrepreneurship—at least in terms of attracting those billions in U.S. venture dollars—entrepreneurs need to give VCs a compelling reason to come to them. In the 1990s, Israel gave them superior technologists. Now, China is giving them an exploding demographic that needs all manner of goods and services. Was a booming Israel just a relic of the 1990s boom like Webvan and the Pets.com sock puppet? I don't believe so. But I'm in Tel Aviv for the next two weeks looking for the company and the tech movement that will prove me right. If you find it, drop me a note. Crunch Network: CrunchBoard because it’s time for you to find a new Job2.0 |

| You are subscribed to email updates from TechCrunch To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Inbox too full? | |

| If you prefer to unsubscribe via postal mail, write to: TechCrunch, c/o Google, 20 W Kinzie, Chicago IL USA 60610 | |

Online shopping clubs along the lines of

Online shopping clubs along the lines of  A new private equity fund has picked up what was left of

A new private equity fund has picked up what was left of

Tel Aviv, Israel—When I moved to Silicon Valley in early 2000, I quickly became fascinated with Israel. A very tight relationship had formed between the holy-land-for-all-things-tech and the actual Holy Land, bolstered by the success of people like Yossi Vardi and Checkpoint's Gil Schwed.

Tel Aviv, Israel—When I moved to Silicon Valley in early 2000, I quickly became fascinated with Israel. A very tight relationship had formed between the holy-land-for-all-things-tech and the actual Holy Land, bolstered by the success of people like Yossi Vardi and Checkpoint's Gil Schwed.

No comments:

Post a Comment