The Latest from TechCrunch |  |

- True Colors: Bathing Mobile In An Entirely New Light

- Apptitude Uses Facebook To Figure Out Which iPhone Apps Your Friends Are Using

- Google Increases Lead In Smartphone Market, But Verizon iPhone Wins February

- Color Updates Its iPhone App With More Intelligible Icons, Navigation And Faster Speed

- 10 Things That Simply Need To Be In iOS 5

- Accel and IDG Double Down on China Partnership, Raise $1.3B in Seven Weeks

- Making Angels: The Pipeline Fund Announces 2011 Fellows

- Mobile Ad Network JumpTap Raises $20 Million

- ‘Rachel Sequoia’ And ‘Share The Air’ Were A Prank, But The Pitch Event Wasn’t

- (Founder Stories) “Every Day, I Try To Get Rejected”

- Amazon’s Cloud Player Tests The Limits Of The Record Labels’ Patience

- Ex-Microsoft Games Chief Apologizes For ‘Consolization’ Of Gaming

- Angel Investors Counter Y Combinator Start Fund With New $100 Million Early Stage “End Fund”

- How Fast Is Your Site? Measure It With Google’s Page Speed Online

- Chinese e-Commerce Site 360buy Grabs $1.5B From DST And Others

- TechCrunch Giveaway: Free Tickets To Disrupt NYC #TechCrunch

- The Onion, America’s Finest News Source, Picks Finest Day To Debut iPad App

- DIY Cloud: Two Hard Drives That Let You Access Files Anywhere

| True Colors: Bathing Mobile In An Entirely New Light Posted: 02 Apr 2011 07:14 AM PDT

Editor's note: Guest author Semil Shah is an entrepreneur interested in digital media, consumer Internet, and social networks. He is based in Palo Alto and you can follow him on twitter @semilshah Color Labs is assumed to be the newest combatant in the photo-sharing wars. Many people ripped its floppy launch, interface, crashes, and some are feeling creepy about the Chatroulette aspect. Then there was the backlash to the backlash, where believers applauded the vision, risk-taking, and promise of mining meta-data from phones. Even with the latest update pushed out last night to address some of the initial product’s shortcomings, Color remains the most polarizing Silicon Valley startup since Quora's rise and, appropriately enough, folks at Color have been answering questions on the company's Quora topic page. The source of the furor varies from the amount of money raised ($41m) to the team size (27) to the buggy app (despite updates). A good chunk of the backlash is because users perceive it as a photo-sharing service. But, what if Color is more than a photo-sharing service? Color Labs is on the record stating they are more of a data mining company with technology that, operating in concert on the phone, can paint a detailed mosaic of our mobility. Its patent-pending technologies are said to able to place users in proximity to others based on sounds and images, can capture the angle at which we hold our phones, how fast we move them in gestures, and how bright the environment is. And when users actually have the camera open, that's when the real show begins, tagging images, setting context, and opening the type of world Christopher Nolan conceived of in The Dark Knight, when Lucius Fox and Bruce Wayne use cell phone triangulation to create a digital reflection of the real world. At the same time Foursquare and Facebook are clamoring to obtain our location, others already have a much better implicit depiction of our whereabouts and purchasing behaviors, mainly credit card companies and phone companies. For months, Facebook's mobile apps have gently signaled to users if friends have been spotted nearby. A few weeks ago, Foursquare inked a groundbreaking deal with AMEX to tie the app to a payments system. And, a well-known secret in Silicon Valley is that Facebook is hard at work building its own mobile operating system that will bake "social" into as many mobile devices as possible. In order to get more information than credit card companies have, the phone companies need the user's assistance and permission. And in the case of Color, the user has to have the app running, preferably with the camera open—at dinner, at a sports game—along with all the other apps competing for attention in a crowded, fragmented mobile apps marketplace. Color could give phone companies the chance to get as much as, or more, information about us than the credit card companies have. Before any of this can happen, however, the question looms: Will Color be able to withstand this initial backlash, iterate, and keep improving on their app? Some believe the team will find its way. Others believe that in such a competitive environment, it's not possible to get a second chance. The truth is that nobody knows, but if Color weathers this initial storm and is successful, what could it evolve into? My sense is that Color Labs is thinking ahead two to three years, by which time users may grow tired of sorting through a constellation of apps and services to share and broadcast their location, purchases, and pictures. Instead, these features will converge in a slightly smaller number of unified apps. We'll have folks using phones running on Android, iOS, or Facebook variants, among others, and we'll have a chance to leverage features from Color Labs's systems. This is what I believe Color Labs is going after: The augmentation of mobile operating systems. Ultimately, they don't want their service to run as yet another fragmented app on your phone—they want their system to entirely augment mobile operating systems, using their technologies to document every sound, image, movement, transaction, and message your phone transmits or receives. The folks creating this system are building tools for a world in which our mobile phones and tablets will take the place of many of today's traditional computing devices. In this world, users will carry around their wallet, books, and other files in their phones and tablets, docking them into monitors and screens as they move from location to location. This is pure speculation on my part and nothing more than a fun attempt to connect some dots. But if a seamless mobile operating experience is their ultimate goal, this is the type of undertaking that truly needs venture capital, and lots of it. Part of the reason folks may be lashing out against the concept and launch is that, frankly, we haven't seen a concept this big emerge for a while. Everyone loves a big concept, but a concept remains just that until the products gets in the hands of enough users to make a real impression. Color Labs may be on a mission to perfect and harmonize its technologies to dramatically augment the mobile operating experience. Its founders are accomplished, its team is big, its technologies are novel. The brand is polarizing. Its a company that can convince Sequoia Capital to invest about 1.8% of its current fund for the chance to build something fresh from the ground up. It's a company that's being built entirely within a mobile world, an attempt to test the lasting power of Facebook's symmetrical relationships and offer, as Fred Wilson notes, a more "implicit," or as the company notes, "elastic" network, one that is built with a different set of rules, norms, and permissions that could perhaps more accurately reflect the random ebbs and flows of our social interactions in real life that have yet to be captured fully by any digital network. Photo credit: Flickr/Pilottage |

| Apptitude Uses Facebook To Figure Out Which iPhone Apps Your Friends Are Using Posted: 01 Apr 2011 11:29 PM PDT

“Quitely” launching in the App Store this week, the App recommendation App is currently number 29 in the App Top Free Apps list, most likely because it incorporates social elements and Facebook Connect as a way of gaging what’s actually hot in the anti-social Apple App Store, where homegrown Top 25 lists leave much to be desired. When you initially open Apptitude and log onto Facebook you see a scrollbar of your Facebook friends stack-ranked by the number of apps they’re using. When you click on your friends’ profiles you can swipe through a series of chosen apps and you can also to drill down into specific stats about how many Facebook friends use the app, many people have Facebook Liked the app as well as into the ability to download directly to your phone. Apptitude creator Shalin Mantri hopes to use all this social app data to eventually create a better way of finding relevant iPhone apps, and tells me that an eventual Facebook-powered recommendations list based on what apps are trending in your social graph will be including in v1.1, which Apptitude will be submitting to the App Store next week. Wish I could be a fly on the wall in the iOS review room on that one. You can download the App here. |

| Google Increases Lead In Smartphone Market, But Verizon iPhone Wins February Posted: 01 Apr 2011 11:19 PM PDT

Following behind Android is RIM, ranked second with 28.9 percent market share, and Apple with 25.2 percent. Microsoft and Palm rounded out the top five, with 7.7 percent and 2.8 percent, respectively. In the big picture, the mobile numbers continue to impress. Over the last three months, an average of 234 million Americans (13 and older) used mobile devices. That’s 75 percent of the population. Nearly 67 million of those mobile users were employing smartphones, representing a 13 percent rise from November. Smartphone usage only continues to grow, as you will remember that comScore’s November report showed smartphone usage growing by 10 percent since the summer of ’10. Of the millions of mobile devices in use this year, Samsung remained the top manufacturer with 24.8 percent of mobile subscribers, followed by LG at 20.9 percent, Motorola at 16.1 percent, and RIM at 8.6 percent. Perhaps unsurprisingly, Apple had the biggest surge since November, gaining a percentage point of market share, though it continues to trail the other manufacturers at 7.5 percent. The principal cause of Apple’s three-month gain? Why the Verizon iPhone, of course. According to comScore, the Verizon iPhone was the most acquired handset in February. Lastly, comScore’s report shows that the many particular uses of smartphones are, again, on the rise. Text messaging, mobile browser use, app downloading, social networking, games, and music all were on the rise on mobile in early 2011. Accessing social networks represented the largest growth on mobile over the last period. |

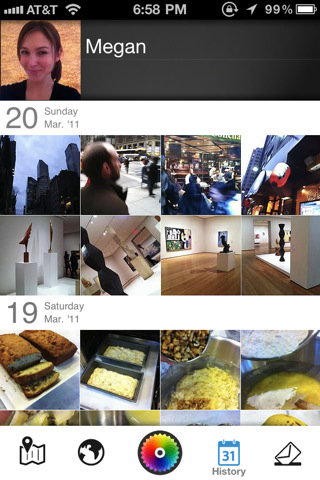

| Color Updates Its iPhone App With More Intelligible Icons, Navigation And Faster Speed Posted: 01 Apr 2011 05:45 PM PDT

Color co-founder Peter Pham tells me the latest update was “crowd-sourced” as in Color listened to user feedback. Already it looks like the largest user complaints have been addressed, at least cursorily. The homepage icons now have text descriptions and are more intuitive to use, like a Map for “Nearby,” a Globe for “Feed,” a Calendar for “History” and a Letter for “News” (the fade text descriptions also really help). The bizarre revolving 69 button has been split into two buttons, the Map and Globe. The Heart button, which allowed users to share photos via Facebook and Twitter, has now been replaced by a more reasonable Paper Airplane button. A Home button also brings users back to their homepage, like it should. Color 1.0.2 also makes it a lot easier to delete a photo, block a user or see more or less of a person (+,-) and view user profiles. In addition you can now choose a Color profile image from your iPhone photo library, which means no more dark, less than ideal profile images. The phone also now comes localized in French, Japanese and Chinese. Color is like Rebecca Black’s Friday video: People hate on it in public but keep going back to it privately. And while this is an improvement over what existed before, Pham tells me there’s an even larger (“pretty major“) re-vamp to come. “This is just the beginning,” he said. The Android app is coming tomorrow. |

| 10 Things That Simply Need To Be In iOS 5 Posted: 01 Apr 2011 05:22 PM PDT

WWDC. It’s like Christmas for OS X and iOS developers. Each year, they flock to San Francisco’s Moscone Center, anxiously awaiting the pair of gifts that Apple annually bestows: the new iPhone, and a bundle of new features on which they’ll build their next big thing. If whispers and hearsay hold true, this year’s WWDC will only feature the latter; the iPhone 5, says the rumor mill, won’t be showing its face until Fall. Instead, this show is purportedly going to be all about iOS and OS X. While Apple doesn’t come right out and say it, it’s pretty safe to assume that by “iOS” they mean “iOS 5″. Given that we’re writing about iOS on a regular basis and talking about it with readers and friends even more, we’ve got a pretty finely-tuned wishlist for iOS 5. We also happen to know that a heaping handful of Apple folk read TechCrunch regularly — and with the feature lock stage of iOS 5′s development cycle (wherein they absolutely refuse to add anything new and just focus on what they’ve already started) presumably riiiight around the corner, we figured there was no better time than now to put it out there. Read the rest at MobileCrunch >> |

| Accel and IDG Double Down on China Partnership, Raise $1.3B in Seven Weeks Posted: 01 Apr 2011 04:57 PM PDT

There was the branch office strategy, whereby the China partners and Valley partners would still work as one firm, making all investment decisions together as a unit and sharing in the returns equally. There was the more common franchise model, where a brand name Valley firm lent its name to a group of local Chinese investors, but mostly left them to make their own decisions. And then there was the joint venture model, where a well known Valley firm didn’t seek to create a China office, it just partnered with an existing one. That last tack – the join venture model – is the one Accel took, partnering back in 2005 with IDG Ventures– one of the pioneers of investing in the Chinese consumer Internet. IDG already had a great hit-rate, having backed an all star roster of Chinese Web giants including Ctrip, Baidu, Sohu and Tencent. But it was investing out of a relatively small seed fund with no allocation for follow-on rounds. That meant a early IDG investment in Tencent netted a tidy 20x return– but paled in comparison to the return that South African media firm Naspers got when it bought the company out in the early 2000s. Naspers bought out existing investors for a cool $30 million, giving it 50% of what has become the third largest Internet company on the planet. Ouch. The partnership with Accel allowed IDG to make sure that didn’t happen again, by co-raising two growth funds (which is more like what we’d consider a classic early-stage fund) and a capital fund over the last six years, a combined total of nearly $1.5 billion dollars that has already yielded seven IPOs. “Even though we did very well with previous IDG funds, we could have done better if we had larger fund sizes and could invest more aggressively in follow-on investments,” says Hugo Shong, the founding partner of IDG who negotiated the original deal with Breyer. Last night, the two closed on the third growth fund totaling $550 million and the second capital fund totaling $750 million. Here’s the best part: The funds were raised entirely in seven weeks, mostly from Accel’s existing US limited partners. Ok, part of that is due to a raging Chinese Web bubble: One-quarter of all US IPOs last year were by China-based companies. But it’s still an impressive feat. Breyer had nothing but positive things to say about the partnership thus far, noting that none of the senior IDG partners has left. Indeed, that’s something not even firms like Kleiner Perkins and Sequoia can boast. And IDG has a 99-person team spanning five cities in China. When I asked what hadn’t gone as well as planned — this is China after all– Breyer said, “The most challenging part is the pace of the market it China. It moderates fast when the market declines, and when it’s up and to the right as things have been in China deals are somewhere between being priced for perfection and outright euphoria. Navigating through the euphoria is a challenge.” When I asked if he was worried about a China crash, he laughed and said, “I’m always concerned about crashes– both here and in China.” |

| Making Angels: The Pipeline Fund Announces 2011 Fellows Posted: 01 Apr 2011 04:50 PM PDT

The Pipeline Fund Fellowship accepted ten women who are influencers in their fields, and have a track record of charitable giving. Together, they will go through a six-month “boot camp” in New York, learning how to route some of their wealth into angel deals, that will score them an equity stake in for-profit, for-good businesses. The founder and chief executive of the Pipeline Fund, Natalia Oberti Noguera (image below) is serious about resolving bias against women that she — and many others — perceived in the investment and startup ecosystem.

Accepted Pipeline Fund Fellows are required to chip in $5,000 each to a collective fund, and agree to select a female-led, for-profit social venture in which to invest their first $50,000 together. They’ll be asked to run a pitch “summit,” which they’ll host in June in New York City, to select the right startup. TechCrunch asked Ms. Oberti Noguera if she is concerned that the philanthropists who get hip to the notion of investing in for-profit social ventures, may wind up slowing down their philanthropic giving. She said she would never encourage them to divert cash from charitable efforts. She also explained:

[Ed's note: While optimistic about programs that support a diverse investment and entrepreneurial community, TechCrunch will be interested to see if these newly-minted angels continue to invest in businesses led by women after the session ends. For more on women in tech, investing and startups, check out TechCrunch's ongoing coverage.]

Image: Snow angel (CC) via Lars Christopher Nøttaasen 2011 PIPELINE FUND FELLOWS Dawn Barber Conor Barnes Monica A. Barrera, D.D.S. Elizabeth Crowell Erica Frontiero J. Kelly Hoey Diane Kaslow Jessica Magoch-Roazzi Emma Nothmann Maggie Williams

Rob Delman, Vice President, Astia; Managing Director, Golden Seeds; Partner, ARC Angel Fund Brad Feld, Co-Founder and Managing Director, Foundry Group; Chair, National Center for Women & Information Technology (NCWIT) Francine Hardaway, PHD, Co-Founder, Stealthmode Partners Katie Rae, Managing Director, TechStars; Co-Founder, Project 11 Ventures Ed Reitler, Partner, Reitler Kailas & Rosenblatt LLC; Founder, Angel Round Capital, L.P. Dimple Sahni, Founding Partner, DS Inc; Co-founder, Epylon.com Kathleen Utecht, Principal, Wharton WVP Ventures Claire Wadlington, Partner and CFO, FA Technology Ventures Mike Yavonditte, Founder and CEO, Hashable |

| Mobile Ad Network JumpTap Raises $20 Million Posted: 01 Apr 2011 04:00 PM PDT

JumpTap is one of the largest remaining independent mobile advertising networks, in addition to Millennial Media, Greystripe, InMobi and others. Jumptap's data-driven technology promises highly targeted advertising and the company partners with digital and media agencies, publishers, wireless carriers and brand advertisers to serve an array of mobile advertising solutions. While it’s unclear who the investors are in the round, the company recently landed a deal with Tokyo-based cyber communications (cci). Part of the partnership included an investment in the mobile ad network, so the SEC filing could relate to this deal. Despite the heated competition in the mobile advertising space, JumpTap appears to be growing, at least in terms of employees. The company added 23 employees since the beginning of 2011 from companies including Apple, IAC, Time Inc, and Maxus. |

| ‘Rachel Sequoia’ And ‘Share The Air’ Were A Prank, But The Pitch Event Wasn’t Posted: 01 Apr 2011 02:04 PM PDT  It’s always feels sort of good to be able to de-bunk a prank on April Fools. Now most of us got that Rachel Sequoia’s insane startup pitch for ‘Share The Air’ was fake, but the event it took place at, the SEO-optimized Venture Capital Fundraising Club of Silicon Valley was real in the sense that 5-6 real start-ups pitched there, hoping to practice in front of an audience of 80 people before they pitched VCs. The whole thing was orchestrated by Trademarkia founder Raj Abhyanker and Spiral Moon’s Dan Carlson for two purposes, a) To give young startups a place to practice their pitches b) To add some levity to the mix with Rachel Sequoia/’Share The Air’ parody of Silicon Valley. Actress Rachel Cherones was paid a $100 for the unorthodox gig and was given two hours to come up with the character after being given slides created by Carlson. She too was surprised by how much pickup the YouTube video, initially uploaded as a personal record of the presentation, received. Said Cherones, “Most of the people that came up to me afterward said, “I don’t care about blessing the air, but I think they’re legitmately a market for what you’re doing.” Heh. The fake Rachel Sequoia account now has over 2,000 followers on Twitter, the video has over 200,000 views on YouTube and people have approached SpiralMoon, who is now working on a feature length film, with acquisition offers. The second meeting of the Venture Fundraising Club of Silicon Valley will take place on April 28th. See you there! |

| (Founder Stories) “Every Day, I Try To Get Rejected” Posted: 01 Apr 2011 01:39 PM PDT If you meet a lot of CEOs and startup founders, you will notice a personality trait that many of them share. No matter how many people tell them they are wrong or stupid, they remain unusually optimistic, almost blindingly so. In the Founder Stories video above, which is an outtake from last week’s interview with Bnter CEO Lauren Leto, host Chris Dixon talks about the importance of rejection. “Every day, I try to get rejected,” he tells Leto. Sometimes this requires him sending emails to Steve Jobs that never get a response. But being able to handle rejection, and even seek it out, is a crucial skill for entrepreneurs. The flip side of getting rejected over and over again, of course, is perseverance. It doesn’t matter if 49 VCs pass on your startup if the 50th one hands you a check for $1 million, or if 24 engineers say No, but the 25th is a rockstar who says Yes. Getting to yes means letting the negativity wash over you. Leto and Dixon also talk about pitching VCs and the need to own the room. Confidence matters. You need to leave the room with investors thinking there is a one percent chance your company can be the next Twitter, Google, or Facebook. Leto had this experience when she raised money for Bnter after Texts From Last Night took off. You can listen to the full interview here. Check out other Founder Stories episodes or subscribe on iTunes. |

| Amazon’s Cloud Player Tests The Limits Of The Record Labels’ Patience Posted: 01 Apr 2011 12:03 PM PDT

|

| Ex-Microsoft Games Chief Apologizes For ‘Consolization’ Of Gaming Posted: 01 Apr 2011 11:41 AM PDT

|

| Angel Investors Counter Y Combinator Start Fund With New $100 Million Early Stage “End Fund” Posted: 01 Apr 2011 11:06 AM PDT

Angel investors panicked, realizing that Start Fund would likely result in soaring valuations. Y Combinator startups were no longer cash strapped, and negotiating leverage moved dramatically in their favor. “Start Fund was created to take traditional angel investors out at the knees,” said one such investor. “It’s highly irresponsible to invest in companies you’ve never met, and there will be unintended consequences that could hurt Silicon Valley over the long run.” Top angel investors were already meeting regularly to align investment strategies to keep startup valuations down. The collusion involved an unspoken agreement (known as the “$4 million line“) not to compete for deals but rather to let one angel lead a deal and set valuation and then that angel would let the others invest alongside them. “That was a superior strategy and we were successfully keeping startup valuations at reasonable levels,” said investor Josh Felser at the time adding that “nothing we did was illegal because it wasn’t in writing.” But Start Fund changed the rules so much that in the last couple of months, say investors I’ve spoken with, the valuations of startups taking investment has increased dramatically. “Start Fund is the single biggest threat to our existence, and we have to adapt immediately” investor Jeff Clavier said at the Web 2.0 Expo earlier this week. Adapt they have. In a joint announcement today on Angellist, top angel funds First Round Capital, Felicis Ventures, FLOODGATE, SoftTech VC, 500 Startups, and Freestyle Capital, and nearly fifty individual angel investors, annouced End Fund, which plans to invest $1 million in 100 new startups immediately. Like Start Fund, entrepreneurs do not need to pitch their business idea or have any products built or even designed. “We’re investing in people, not ideas,” says First Round Capital’s Josh Kopelman in the release. Dave McClure, principal at participating fund 500 Startups, will lead End Fund as the fund’s only general partner. McClure was chosen, say insiders, based on his ability to make quick investment decisions based on little or no information at all. Last year, for example, McClure invested in a startup who gave him a ride to a meeting. "You did this without any due diligence or research into the company?" I asked him at the time. His answer – "Yes, but I had a referral from someone." “This is a blanket $1 million investment offer to virtually any new technology startup,” says McClure. Like Start Fund, the money is offered as a convertible note with very few conditions. Startups must fill out a web form containing five basic questions about their startup, including a one word description of the business, and agree never to take an investment from Start Fund. The first 100 startups to complete the web form and agree to the basic terms will be given the $1 million via a wire transfer. There is some fine print beyond the initial requirements. Applying entrepreneurs must also have their own computers, internet access and an email account. And the company’s next round of financing cannot be closed at a pre-money valuation of more than $4 million, and the company is only permitted to raise equity in the future from the funds and individual angel investors involved with End Fund. “Unlike Start Fund, which limits its investments to Y Combinator companies, End Fund will invest in any startup at all, with virtually no questions asked and on a first come, first served basis.” The group says that this will reduce risk considerably because of the deeper pool of talent they have to tap v. Start Fund. And the fact that only the first 100 startups to apply will get the funding means that the fund will automatically be structured to favor entrepreneurs who can make decisions and then execute very, very quickly. “We are at a unique point in history, where any two people can create a new startup and have a nearly certain chance of at least modest success,” says McClure. “Even if the product fails completely, Google and Facebook will compete to acquire the team and investors will at least get their money back.” Milner and the SV Angel team could not be reached for comment |

| How Fast Is Your Site? Measure It With Google’s Page Speed Online Posted: 01 Apr 2011 11:04 AM PDT

Editors note: The following guest post is written by Josh Fraser. Josh is the co-founder of a new startup called Torbit which automatically optimizes websites for speed. Yesterday Google announced Page Speed Online, which provides a quick and easy way to accurately measure the speed of your website directly from the web. Previously available only as a browser add-on, Google Labs launch allows you to analyze your site from anywhere and receive instant feedback on making it faster. Chances are, your website could perform better—all of ours could. There are a lot of tools online that only measure server response time, giving an inaccurate picture of your site's speed. For example, blazing fast servers might return your HTML in a fraction of a second, but visitors to your site will still be waiting for images to download or javascript to be executed. In contrast, Page Speed Online uses a webkit-based renderer to time all components of your site for a more complete picture of its performance. Page Speed Online is simple to use. Just enter a URL and get instant suggestions for performance improvements on your site. Page Speed Online gives you a score out of 100 and breaks down suggestions by their priority. Google caches the results, making it faster to use than comparative tools like WebPageTest which offers more features. With Page Speed Online you can also get mobile-specific recommendations. For instance, since mobile device CPUs are less powerful than desktop CPUs, suggestions that reduce CPU consumption will be featured more prominently. Performance matters. We all know that. Everyone can relate to the frustration of waiting on a site that takes forever to load. Website owners in particular should care about performance. The correlation between the speed of your website and revenue has been shown over and over again. Improving your site's performance is the easiest way to increase pageviews, conversions and sales. For example, Yahoo found that a 400ms improvement to the speed of their site increased their pageviews by 9%. Firefox shaved 2.2 seconds off their average page load time and increased download conversions by 15.4%. Shopzilla reduced their loading time from 7 seconds to 2 and increased their pageviews by 25% and revenue by 7-12%. Google has been a long-time champion of making the internet faster. Not only did it rise to prominence by being the fastest search engine, but it also encourages other sites to be fast by using site speed in its web search ranking. Google has also released a slew of tools to help website owners measure and improve the performance of their sites. Google released Page Speed plugins for Firefox and Chrome and include performance data in its webmaster tools. Just yesterday, Steve Souders announced HTTPArchive which keeps an archive of how top websites are built and tracks their performance ranking over time. The data is being recorded using real browsers so the archive is an accurate representation of the experience of actual visitors. Performance is obviously a priority for Google and it's something we all value. Venture capitalist Fred Wilson even calls speed "the #1 feature for startups". Page Speed Online is an important step for the web because it's lowering the bar for people who want to do performance analysis on their sites. You no longer have to download desktop software, install a plugin or even have a copy of the browser that you're testing – all you need is any browser. Google employee and performance guru, Steve Souders told me a story from a party he attended where a startup CTO was asking him for site improvement suggestions:

I also talked with the tech lead for Page Speed Online, Bryan McQuade and asked him what was next for the service. He says:

Of course, Page Speed Online will only tell you that your site is slow; it won't fix it for you (although there is an Apache module that helps). Our company, Torbit, and others such as Disrupt runner-up CloudFlare and Blaze.io, are working to automate all these best-practises to make websites fast. Torbit is still in private BETA, but you can sign up now to get in before our public launch. |

| Chinese e-Commerce Site 360buy Grabs $1.5B From DST And Others Posted: 01 Apr 2011 10:41 AM PDT

The Yuri Milner-led DST has put in $500 million of the $1.5 billion in funfing, with Tiger Fund, Walmart and others completing the rest of the round. If you’ve read Sarah Lacy’s extensive chronicling of the region, it comes as no surprise that the same investment group that made a successful bet with Facebook and Groupon has now set its sights on the burgeoning opportunities in Chinese e-Commerce. The e-Commerce industry in China as a whole saw $79 billion (520 billion yuan) in sales last year, and 360buy.com itself made an estimated $1.7 billion in sales in 2010. DST also raised another $500 million in December from six investors including Walmart again. |

| TechCrunch Giveaway: Free Tickets To Disrupt NYC #TechCrunch Posted: 01 Apr 2011 10:10 AM PDT

For every Friday leading up to Disrupt NYC, we are going to give 1 ticket away to one lucky reader, fan, or follower. The tickets start at $1,795, later going up to $2,995. The way to win the tickets may change, but the prize will remain the same. If you want a chance at winning this week’s ticket to Disrupt in New York City, just follow these steps to enter: 1) Become a fan of our TechCrunch Facebook Page: 2) Then do one of the following: - Retweet this post (making sure to include the #TechCrunch hashtag) The contest starts now and ends tomorrow, April 2nd at 7:30pm PST. Please only tweet the message once or you will be disqualified. We will choose at random and contact the winner this weekend with more details. Anyone in the world is eligible and we will be announcing the winners on our Facebook page. Please note these giveaways are for 1 ticket only and do not include airfare or hotel. If you do not win this week be sure to check back next Friday. Good luck! |

| The Onion, America’s Finest News Source, Picks Finest Day To Debut iPad App Posted: 01 Apr 2011 09:32 AM PDT

This is not a joke. The Onion, “America’s Finest News Source” (TM), released its iPad app fittingly enough on April Fools Day. IPad apps are serious stuff. This one delivers fake news stories, videos,and images from the parody site in both vertical and landscape modes. It’s a pretty basic fake-news reading app, but it gets the job done. You can swipe through stories, watch videos, check out funny charts. Articles can be shared via Facebook, Twitter, Tumblr, and Google Reader or saved to read later via Instapaper or Pinboard. All pretty standard. From the press release:

The app relies heavily on HTML5, and it should be popular. The Onion’s other mobile apps on the iPhone and Android have been downloaded more than one million times. |

| DIY Cloud: Two Hard Drives That Let You Access Files Anywhere Posted: 01 Apr 2011 09:19 AM PDT

It has long been a dream of mine to connect a hard drive at home to the Internet. This dream, of late, has been deferred by the rise of cloud services like SugarSync and Dropbox but two hard drive manufacturers, Buffalo and Iomega, have come out with compelling devices that seem to finally allow home and home office users to get the benefits of cloud hosting with the safety of complete control over your data. The two devices, the Buffalo CloudStor and the Iomega Home Media Network Hard Drive, come in multiple sizes and sit on your network. They are, for the most part, plug and play except for a quick port change for the Iomega drive. I’ve put them both together as their feature sets are similar in process but intrinsically different in performance. |

| You are subscribed to email updates from TechCrunch To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

Bye bye 69 symbol! Valley media darling/scapegoat

Bye bye 69 symbol! Valley media darling/scapegoat

When Silicon Valley venture firms set out to conquer China five-to-seven years ago, most of them picked one of three strategies.

When Silicon Valley venture firms set out to conquer China five-to-seven years ago, most of them picked one of three strategies. The New York-based

The New York-based  She believes that women with enough cash to become angels, while they may not be “needy,” could use help from seasoned investors figuring out: what makes a viable portfolio strategy, how they should conduct due diligence, valuations, or scare up a strong pipeline of deals. She’s enlisted accredited angel investors, many of them men she noted, as mentors.

She believes that women with enough cash to become angels, while they may not be “needy,” could use help from seasoned investors figuring out: what makes a viable portfolio strategy, how they should conduct due diligence, valuations, or scare up a strong pipeline of deals. She’s enlisted accredited angel investors, many of them men she noted, as mentors.

Mobile ad network

Mobile ad network  Amazon may have introduced its digital locker music service, the Cloud Player, before similar services from rivals Google and Apple (that are widely

Amazon may have introduced its digital locker music service, the Cloud Player, before similar services from rivals Google and Apple (that are widely  Robbie Bach, the former president of Microsoft’s Entertainment and Devices division, has apologized to PC gamers for the "consolization" of their hobby. "Am I happy to have been a part of the destruction of PC gaming? No, of course not. But I am proud of the fact that I’ve helped convince a generation of gamers that it’s cool to pay $10 for a pair of virtual sunglasses and that playing online should be considered a premium feature. Look, guys, no one’s stopping your from installing Doom II and playing through that again, right? I mean, what’s the difference between that and Black Ops, really?"

Robbie Bach, the former president of Microsoft’s Entertainment and Devices division, has apologized to PC gamers for the "consolization" of their hobby. "Am I happy to have been a part of the destruction of PC gaming? No, of course not. But I am proud of the fact that I’ve helped convince a generation of gamers that it’s cool to pay $10 for a pair of virtual sunglasses and that playing online should be considered a premium feature. Look, guys, no one’s stopping your from installing Doom II and playing through that again, right? I mean, what’s the difference between that and Black Ops, really?" In a move reminiscent of

In a move reminiscent of

Yesterday we were hearing reports that global investing behemoth Digital Sky Technologies

Yesterday we were hearing reports that global investing behemoth Digital Sky Technologies

No comments:

Post a Comment