The Latest from TechCrunch |  |

| Oracle Wants To Be The Apple Of The Enterprise, But It Just Became IBM Posted: 20 Apr 2009 08:00 AM PDT

Larry Ellison has always wanted to be the Steve Jobs of the enterprise. With this morning’s announcement that Oracle will buy Sun Microsystems for $7.4 billion, he took a big step towards making Oracle more of a soup-to-nuts provider of enterprise technology. With Sun, he will now be able to build and package together everything from chips and servers to operating systems, Java middleware, databases, and enterprise applications. Here is the money quote from Ellison on the deal:

Like Apple, Oracle wants to take away complexity for its customers and bundle the entire IT stack neatly together so that it works without hassles and is optimized for Oracle’s software. With this deal, Ellison has come full circle from his early-1990s mantra of “best-of-breed” systems, which he abandoned long ago. Rather than look like Apple with its dedication to making the perfect product, Oracle just became IBM. It will use Sun’s existing server market share to push Oracle databases and software, and bundle it all with IT services. Sure, it will continue to support Dell and HP and even rival enterprise software, but the sales pitch will be around the bundled product. If that turns out to be a superior product at a lower price, then both Oracle and customers will win out. But to the extent that it takes away choice from IT buyers, it could be an even tougher sell than convincing them to give up their beloved Blackberries for an iPhone. How different really is Oracle buying Sun than if IBM had bought it, other than the price? Sun’s powerful servers are a way to sell expensive software—always have been, always will be. A big motivation for the deal was to acquire Sun’s Solaris operating system and Java. As hardware margins keep getting squeezed, that software component becomes more and more important. At least with Oracle, Sun will stay in the Silicon Valley family, so to speak. But what may be the most valuable part of the deal from Oracle’s perspective, although Ellison hardly mentioned it, is MySQL. Oracle now owns the open-source database Sun acquired last year for $1 billion. As MySQL grows in popularity, it keeps disrupting Oracle’s high-end database business from below. Now Oracle can at least try to disrupt itself, or kill MYSQL (which would be a bone-headed move). What makes more sense is a two-pronged approach: On the high-end, sell highly optimized Sun servers running Solaris, Oracle databases, and Oracle enterprise apps. On the low-end, sell MySQL on Dell and HP servers running Linux. Another unanswered question is what will happen to Sun’s cloud computing efforts, given Ellison’s disdain for the term. Watch him change his tune on that one as well. Crunch Network: CrunchBase the free database of technology companies, people, and investors |

| BlueStripe Scores $8 Million For Virtualization Software Posted: 20 Apr 2009 07:31 AM PDT

BlueStripe Software, a company that sells application service management software, secured a $8 million in Series B funding from Valhalla Partners and Trinity Ventures. The company secured $5 million in Series A funding in 2007 from Trinity Ventures. BlueStripe says it will use the funding to expand business operations, create new products and further sales and marketing efforts. Founded in 2007, BlueStripe helps enterprises stage, deploy, and manage business applications in the server environment. BlueStripe’s flagship product, FactFinder, gives businesses the intelligence to manage business‐critical applications during physical to virtual (P2V) conversions, new application roll-outs, and production deployments. Crunch Network: CrunchBase the free database of technology companies, people, and investors |

| Digg Ditches Microsoft To Sell Its Own Ads Posted: 20 Apr 2009 06:55 AM PDT

Microsoft gets the leftovers, i.e. remnant inventory. The partnership between Digg and Microsoft was initially supposed to last until mid-2010, but according to Mike Maser, Digg’s chief revenue and strategy officer, the two always had an understanding that Digg would at some point start selling the majority of its own ads. He added that the company’s internal sales efforts will focus on custom, non-IAB inventory combined with standardized banner ads. This is not necessarily a sign that Microsoft was underperforming, although it’s clear Digg stands to make more money from advertising running its own sales. The move is not a surprise in that regard, and this type of switch happens regularly when websites grow enough to build their own internal sales teams. In January, Digg hired former Yahoo sales exec Thomas Shin, its first ad sales executive, and is currently recruiting a nation-wide sales force. By the end of the year the company hopes to hire a total of five to seven reps in San Francisco, the Los Angeles area, Chicago and New York. Ironically, Digg CEO Jay Adelson put the two following bullet points together in a blog post published earlier this year in which he highlighted what Digg’s focus in 2009 would be on its path to profitability: - Building on our advertising infrastructure I guess we can now stop calling that last one a priority for this year. Crunch Network: CrunchGear drool over the sexiest new gadgets and hardware. |

| Oracle To Buy Sun For Approximately $7.4 Billion - Hold On To Your Hats Posted: 20 Apr 2009 04:57 AM PDT Oracle Corporation is to buy Sun Microsystems for $9.50 a share in a deal valued at approximately $7.4 billion, just a few weeks after a deal by IBM to buy Sun fell apart. It looks like Oracle will pay a premium of $2.81 a share, or 42%, over Sun Micro’s closing price of $6.69 a share on Friday. Oracle said the deal is valued at $5.6 billion excluding cash and debt. Oracle is calling Sun’s Java “the most important software” it has ever acquired. The deal, which is expected to close in the Summer and was unanimously approved by Sun's board of directors, has massive implications for the future openness of Java and MySQL.

As the NY Times points out, Oracle and Sun are two heavyweights that have been partners for more than 20 years, even if Oracle has been distancing itself a bit from Sun’s server line in favor of competitors like HP and Dell lately because of Sun’s business decline. As a result of this deal, Oracle will now become a behemoth in both the software and the hardware market, and the implications this acquisition will have on the its closest rivals and the market in general will be noticable for years to come. The official release, with emphasis ours:

Crunch Network: CrunchBase the free database of technology companies, people, and investors |

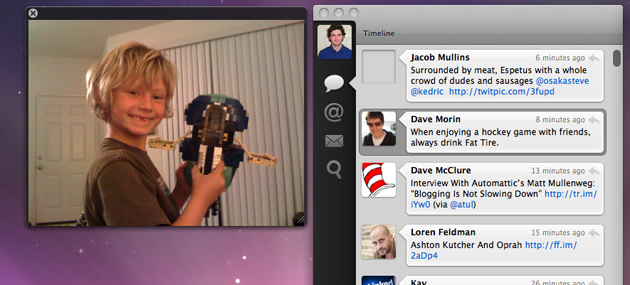

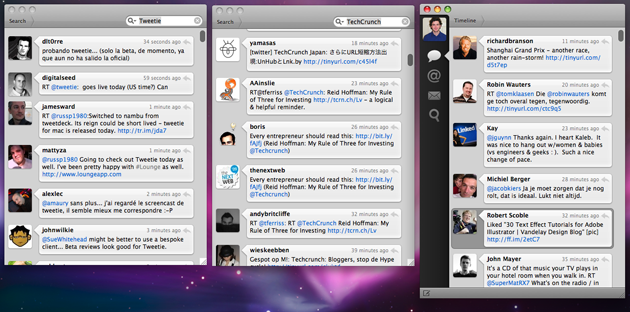

| Tweetie For Mac: A Powerful, Native Twitter Client For The Masses Posted: 20 Apr 2009 04:30 AM PDT Today sees the public launch of Tweetie for Mac, the desktop-based big brother of what many (myself included) consider to be the iPhone’s best Twitter client. I’ve been playing around with a beta version of the app for the last few days since my initial preview last Thursday, and I’m happy to say that my enthusiasm for the application hasn’t waned. It’s sleek, it sweats the small stuff, and it’s going to be my Twitter client of choice for the foreseeable future. But it isn’t perfect, yet. First things first. If you’re one of the so-called ‘power users’ who rely on TweetDeck’s custom grouping features, Tweetie probably isn’t for you. The application goes well beyond most basic Twitter clients in terms of functionality, but it isn’t an uber-dashboard that’s going to take up an entire monitor. If you’re okay with that, read on. At first glance, Tweetie is deceptively simple. The client consists of a single column displaying your latest stream of incoming Tweets, with four icons arranged on the left side where the majority of navigation takes place. Each icon is self-explanatory for anyone who has used the service before: an ‘@’ symbol represents replies; an envelope is for direct messages; and a magnifying glass for search. Navigating beyond this main menu, everything is intuitive - double clicking on a user name takes you to their most recent tweets, clicking on a hashtag runs a search for it, and so on. The application’s real appeal lies in the details. Every time you click to open an image from services like TwitPic, the app displays the picture in a nifty popup rather than opening a full web browser. To post one of your own images, you simply need to drag and drop it from the desktop into the Tweetie window. The app also supports global hotkeys (you can activate Tweetie with a shortcut even if you’re working in a different application). And from an aesthetic standpoint, everything looks great: navigating between sections activates a smooth transition, you can ‘endlessly scroll’ through tweets as the app continuously downloads new ones, and the interface is very clean. Also a big plus: Tweetie supports multiple accounts, which even some of the ‘power’ apps don’t do properly.

And while the app doesn’t offer a true columned UI, it does offer a compromise: Tweetie allows users to break search queries into their own windows, which I actually prefer to having one giant unwieldily window taking up my screen. That said, a few of the navigation options are a little awkward, and the application will feel foreign for the first few days that you use it, especially if you’re coming from a multi-column client like TweetDeck.

Aside from the initial foreignness, Tweetie does have some issues that may confuse new users. For one, while the app allows you to create as many new windows as you’d like for searching, they’re confusing to activate (you need to click the search button, then go to the menu bar and hit ‘open new window’) and there’s currently no way to pop out the ‘@mentions’ or ‘direct message’ columns into their own windows (this is coming in version 1.1). The option to ‘follow’ a user is tucked away in a drop down menu when it should be more prominent. And there’s also apparently no auto-complete for Twitter handles, which can make responding to friends frustrating. Minor gripes to be sure, but in an app with this much polish they stick out. For a long time I’ve been looking for a Twitter client that felt like it actually belonged on the Mac, and frankly I haven’t had much luck. Twitterific offers a native client, but it is fairly basic. So I turned to more robust clients like TweetDeck, and more recently Seesmic Desktop, which are both very powerful and have a dizzying array of options. But my fundamental issue with both of these apps is that they’re built on Adobe’s AIR platform, which seems to invaribly lead to excessive resource usage on my Mac, not to mention weird UI quirks. I’ve hardly been suffering, but they’re nuisances that have continuously irked me and I’m glad to be rid of them. Tweetie isn’t for everyone, but I suspect its mix of power and simplicity will appeal to quite a few people, particularly those who find other Twitter clients intimidating. Tweetie is available for free with advertising, or for $14.95 for an ad-free version (it will jump up to $20 in two weeks). If you are on a Mac and crave your multiple columns, be sure to check out Nambu, which I’ve also enjoyed using for the last few weeks. Crunch Network: CrunchBase the free database of technology companies, people, and investors |

| How Many New Twitter Users Post-Oprah? A Lot. Maybe Over A Million. Posted: 20 Apr 2009 04:05 AM PDT

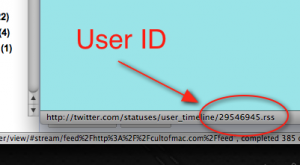

So did 1.2 million people actually sign up for Twitter as a result of Oprah? It’s possible, but tracking down this data is a bit tricky. I asked Block what method he used, and he told me he looked at the user ID on a Twitter account from early Friday versus one from the afternoon on Sunday. You see, while most people only know their Twitter name, if you look at the RSS feed for your Twitter account, you’ll see a number assigned to it — that’s your user ID, and Twitter increments it upward as new people sign up. An account I created just now, for example, has an ID of 33471207. One I created on Friday night (a few hours post-Oprah) had an ID 32779621. Does this mean 700,000 signed up between then and now? Probably not. Twitter has a lot of users, but it does not have 33 million. The reason the user IDs are that high is because Twitter stopped incrementing the number sequentially in March 2007. While it’s not entirely clear what method it switched to, at least one theory had it going back and forth between sequential and increments of 10. If that pattern is correct — and there isn’t much to suggest that it is, but bear with me — then it would probably make sense to divide any number you get by 5 (half of 10 because it’s not always going up by 10). But, as I noted, my first number was from Friday night. That was a few hours after the show, and likely after many of the new users had finished signing up. So I went back to look at other users who likely signed up around the same time. Oprah, herself, isn’t a good one to use because while she started tweeting on Friday, her account was actually created in March — 2007, as Twitterholic notes. I’m pretty sure someone else had control of it until about a week ago when Oprah took it over. But Gayle King, editor of Oprah’s O magazine, did sign up right around then. She technically signed up on April 16, the day before the Oprah show. Her ID is 29546945.

Again, that’s all contingent on an assumption that Twitter is incrementing the numbers in this odd rotation — which is far from a sure thing. But it’s certainly not doing it entirely sequentially, so it’s not to unreasonable to think that the number of users that signed up between Oprah’s show on Friday and today is somewhere between 500,000 and 1.5 million. And that’s huge. Almost exactly a year ago, we noted that Twitter likely had somewhere just north of a million total users. The service has exploded in popularity since then, and recent estimates have it somewhere in the 5 to 10 million users range. That means that Oprah may have helped bring on a significant percentage of new users in just a few days. Not that it’s shocking in the least. Yes, some of those users would have signed up anyway, some were there for the Kutcher/CNN showdown, and a lot are likely spam. But a very good chunk are thanks to Oprah. Naturally, I asked Twitter for some actual numbers to share, and co-founder Biz Stone said they hadn’t planned to release any, but thought it might be interesting, and that he’d look into it this week. So you can probably expect a blog post from him sometime this week, though I’m sure it will be vague, showing spikes in sign-ups in relation to other days — rather than actual numbers. Crunch Network: CrunchBoard because it’s time for you to find a new Job2.0 |

| Prezi Is The Coolest Online Presentation Tool I’ve Ever Seen Posted: 20 Apr 2009 03:26 AM PDT

If you think you’ve heard that too many times, don’t stop reading just yet, because this one is just plain awesome. It’s an entirely Flash-based app that lets you break away from the slide-by-slide approach of most presentations. Instead, it allows you to create non-linear presentations where you can zoom in and out of a visual map containing words, links, images, videos, etc. This is similar to pptPlex, a Microsoft Office Labs project that aims to bring that type of functionality to PowerPoint. It’s really no use explaining how presentations come out without seeing it for yourself, so it pains me that there’s currently no way to embed the examples that are showcased on the Prezi website. Instead, you will need to jump to examples in another tab or window, but please do it: good examples are ‘AIESEC’ and ‘Technical Investigation ICYA’. It takes a while to get used to the way Prezi lets you create presentations, although the interface is fairly intuitive once you’ve grown accustomed to using the ‘Zebra’. There are a number of tutorial videos to assist you in creating your first Prezi presentations. To get started, you can use the free version which brands every presentation with a Prezi logo, offers 100 MB of file storage, comes with an offline player but without the ability to make presentations private. For €39 a year, you get all that but 5x the amount of storage space and the option not to have your presentations made public. A third ‘Pro’ version costs you €119 per year but features a cool desktop application you can use to create and edit Prezi presentations offline. Besides offering paid versions of the software, Prezi also has other revenue streams, like selling DVDs and offering branding services. Try it out and let us know how your presentations come out! Crunch Network: MobileCrunch Mobile Gadgets and Applications, Delivered Daily. |

| TiVo To Sell Fresh, Localized Bad News To Advertisers Posted: 19 Apr 2009 11:03 PM PDT

Now, to be clear, this data will be anonymous, and TiVo has actually been doing this to some extent for several years. But tomorrow, the company plans to unveil a better challenger to Nielsen, the leader in TV audience data, USA Today reports. This type of data is vital to television advertisers because it dictates their ad sales. And TiVo thinks it can provide better data for more markets by using its 3 million plus subscribers, to dish out data that can be broken down by the second. TiVo is trying to play up the fact that such data can be useful to not only advertisers, but to television shows themselves. This way, they can see what parts of shows people skip through — so news shows, for example, can better tailor key content. But this is really about the advertisers, who will want to know what ads people are skipping through, and at what times, during what programs. I’ll make this simple: While not all DVR owners may skip through all commercials, I would bet that anyone who took the initiative to buy a TiVo — a separate box that costs a few hundred dollars and requires a subscription fee on top of your cable bill — skips through just about all commercials, period. This data from TiVo will apparently come from all but the smallest of the 210 television markets. That’s nice, as it’s a lot more than Nielsen, which generally just offers constant in-depth reports for the largest markets. But Nielsen’s data undoubtedly covers a much wider range of the overall population. In fact, that idea led to the most curious line in USA Today’s piece as stated by TiVo’s audience research and measurement general manager, Todd Juenger. He says, that on top of being richer and better educated, TiVo owners tend to be “unfortunately, a little more white” (than the overall population). Perhaps TiVo should just publish its data directly to Stuff White People Like. Seriously though, as a former TiVo owner, I feel for the company. It offers a truly great product, but it’s simply hard for most people to justify paying to put yet another box in their increasingly cluttered living rooms — and asking them to pay yet another monthly fee for it. The cable companies DVRs are absolutely dreadful, but they are cheaper, and come in cable boxes. The company is making some right moves by offering other services, like Netflix Watch Instantly and Amazon’s streaming movie service on its boxes, but it still has to give a reason for users to pay a relatively high monthly fee for the TiVo service. TiVo can sell all the data it wants, but unless it can reverse the trend of subscribers leaving the service behind, none of that will matter. [photo: flickr/flyinace2000]

Crunch Network: MobileCrunch Mobile Gadgets and Applications, Delivered Daily. |

| Reid Hoffman: My Rule of Three for Investing Posted: 19 Apr 2009 10:52 PM PDT

TechCrunch and Founders Fund announced the first annual TechFellow Awards last week. This is a great time to stimulate investment and recognize and encourage tech entrepreneurs –starting up is cheaper, talent is more fluid, and people are more inclined to take calculated risks. If we can find more ways to spur investment, it will be good for the entrepreneur now and good for society later. As a serial investor, I've enjoyed backing some good Web 2.0 companies, and it's helped me develop a shortlist of criteria to cut the wheat from the chaff. After five minutes of a pitch, I know if I'm not going to invest, and after 30 minutes to an hour, I generally know if I will. Many entrepreneurs are product-focused, which leads them to pitch the brilliance of the product. Others are money-minded, so they can over think the business plan. But neither of these approaches answer the first few questions I want to know as an investor: 1. How will you reach a massive audience? In real estate the wisdom says "location, location, location." In consumer Internet, think "distribution, distribution, distribution." Thousands of products launch every month on hundreds of thousands of new Web pages. How does a company rise above the noise to attract massive discovery and adoption? YouTube did it through existing channels like MySpace, which already reached millions. Yelp had strong SEO, which found them a mass audience searching for restaurants and nightlife. Facebook's University-centric approach landed them 80% adoption across a campus within 60 days of launch. Every Net entrepreneur should answer these questions: How do we get to one million users? Then how do we get to 10 million users? Then how will you get deep engagement by your users. 2. What is your unique value proposition? The Internet space is crowded. A product needs to be sufficiently innovative to distinguish itself from the pack, but not so forward thinking as to alienate the user. Many entrepreneurs create incremental improvements on existing products. This can be big – Google revolutionized search when AOL and Yahoo! were presumed to have it locked up – but more often, the pitch sounds like, "It's a dating site, but for senior citizens…" I want to see innovation that is categorically distinct from existing propositions. Digg lets users decide which headlines are newsworthy. Last.fm tracks music listening with an iTunes plugin and buffer great music discovery. Flickr enables users to share and tag photos in new ways. 3. Will your business be capital efficient? This may be the most important of the three. Even if you have a mass audience and unique value prop, a business fails without cash flow. An initial round of financing is important, but how reliable is later financing? Will investors see the right elements in the next stage? Your product must scale intelligently – this is why I like software. A well-coded site can adapt to mass demand without its capital expenditures scaling out of control. A product like TypePad can grow to 10 million users without half the growing pains of a service like WebVan, the Web 1.0 startup that attempted to deliver groceries to users' doorsteps. Try reaching Facebook scale with a service like that. With these three elements in place – mass audience, unique value, stable funding – a startup has time to discover where it can make money. Few business plans ever pan out like their owners intend. PayPal started as a plan to beam payments between Palm Pilots. Google raised funds with a vision to capitalize on enterprise search and ended up in advertising. The formula is to build an audience with a great product – then secure enough funding to figure out how to make it pay. Since I'm focused on building LinkedIn, I'm not currently investing in new projects, but I firmly believe now is the time to take smart risks as entrepreneurs and investors. I hope these criteria help startups make better pitches as they fundraise, and maybe even encourage others to take the plunge. Good ideas need good strategy to realize their potential, and if these criteria help a few more companies find capital, it's a win for everyone. Crunch Network: CrunchBase the free database of technology companies, people, and investors |

| Posted: 19 Apr 2009 06:49 PM PDT

The company has announced just $5 million in funding from Sutter Hill Ventures, but they may have burned through substantially more than that. There was rumored to be a previous angel round of nearly $2 million, and the founders took $3 million or so off the table in 2008. Sutter Hill may also have bridged the company an additional $2 million Along with the venture debt, the company may have raised as much as $14 million in capital. At this point, all equity holders other than the cashed-out founders are wiped out. The startup provided text messaging based marketing services on behalf of brands, similar to competitor Mozes. We’ve added it to the deadpool. Crunch Network: MobileCrunch Mobile Gadgets and Applications, Delivered Daily. |

| Now Even The New York Times Is Entering The URL Shortening Arena … Kinda Posted: 19 Apr 2009 03:19 PM PDT

And just when I thought I’d had it with that type of service for a while, we caught wind of one that made me raise my eyebrows. Enter NytUrl, the ‘trusted’ URL shortener for NYtimes.com articles. Update: The site and all the redirects were taken down “due to abuse.” According to the website, the service shortens URLs for NYTimes.com articles, although a quick test shows that it’s definitely not restricted to other websites (see http://nyturl.com/34 and http://nyturl.com/35), even if it occasionally says the URL is not valid for any other site. This of course defeats the entire purpose of the service, which is to reassure people clicking the links that they’ll wind up on the NYTimes.com website. My guess is that the ability to add links to other websites will be disabled soon enough. NytUrl also comes with a handy bookmarklet and a basic API, but the website claims this is just the beginning and that there are lots of new features coming soon. Here’s the strange part: this service is not operated or even endorsed by the New York Times. In fact, the official Twitter account @NYTimes uses bit.ly for links to articles, even if some NYT related accounts are apparently already using NytUrl.com, as evidenced by this Twitter search query (and these example tweets). So what gives? A WHOIS search for the owner of the nyturl.com domain name doesn’t reveal a thing since his or her identity has been protected upon registration, but according to our source this is effectively the work of two NYTimes employees, namely one of the group’s Senior Software Architects, Jacob Harris and in-house developer Michael Donohoe. Which checks out, because Harris is a self-proclaimed Twitter fan and NYTimes aficionado, and according to the bio posted on the SXSW website (where he was a panelist for one of the sessions) he’s also the one who set up the Twitter feeds for a variety of NYTimes related accounts. Donohoe even lists the NytUrl service on his website, so no doubt he’s involved. Update: Donohoe got back to a request for more information but declines to share more details. And in case you’re wondering why Harris isn’t using nyt.com (which is owned by the NY Times and forwarded to the main website) for the service, which would knock another 3 characters off the shortened URLs: our source says this was likely a grassroots initiative which hasn’t been approved by any of the decision makers at the NY Times, and that it’s not clear if it’s even going to be in the future. It does raise interesting questions: is it a good idea for media companies to obtain control over the short URLs they broadcast across the net and link back to their content? Will netizens lend more credibility to media-owned URL shorteners? Or should they just be using what is out there instead of adding yet another one to the fray? (Note that we use tcrn.ch ourselves for our Twitter account, and that you can see the shortened URL for any of our posts right next to the comment box, in this case http://tcrn.ch/Lk) Your thoughts on this? Crunch Network: CrunchBoard because it’s time for you to find a new Job2.0 |

| The Spot Runner Saga Continues: Founders Accused Of A “Pump And Dump” Scheme Posted: 19 Apr 2009 01:54 PM PDT

TV advertising startup Spot Runner really is running on fumes. According to a lawsuit filed by one its irate investors, advertising giant WPP, Spot Runner has “expended all but approximately $20 million of its investor capital, while losing money at the rate of $35-$45 million a year.” The company has raised $100 million since 2006, and at one point employed more than 500 people before a string of layoffs cut that number down significantly. The lawsuit states that the company had a loss of $45 million in fiscal 2008, on revenues of only $9 million. And in fiscal 2007, it lost $35 million on revenues of $5 million. And here’s the zinger. While Spot Runner was losing all that money, its founders and two early investors (Index Ventures and Battery Ventures) sold shares worth $54 million. CEO and founder Nick Grouf took the lion’s share of those proceeds, netting $26.7 million in five transactions between Feb/March, 2006 and March, 2008. Battery and Index each sold $11.7 million worth of shares (nearly doubling their initial investments of $6 million each). While co-founder David Waxman walked away with only $3.6 million and investor Bob Pittman $365,000 worth of shares. The main complaint of the lawsuit states:

WPP alleges that they did this “surreptitiously” and without disclosing it to other investors. As one of Spot Runner’s largest investors, WPP put a total of $11.8 million into the company. But it is hard to feel sorry for WPP. Basically, it argues in the suit that it should have been able to sell its shares to greater fools as well. It is suing because it wasn’t told about the secondary share sales and wasn’t invited to participate until the very last one, and even then only after it complained (WPP was allowed to sell $900,000 worth of stock at that time, while the defendants made off with $17.8 million). What is not clear from the suit is how much of that $54 million in proceeds, if any, came from fundraising rounds for the company itself versus private secondary sales. Spot Runner won’t comment on any of these numbers other than to say “the complaint contains many inaccuracies.” With the IPO window closed for many startups, secondary private sales of stock are becoming more popular, especially for founders. That practice is fine if the company succeeds. Nobody is going to care if the founders took some money off the table along the way if everyone gets rich in the process. It is when things don’t go so well that investors start to complain and the lawsuits start flying. Regardless of the merits of the case, it is not a good sign when one of the largest investors of a startup decides that the best shot it has at ever getting any of its money back is in court instead of in the market. WPP is seeking $13.2 million in damages. And it is not the only one who is angry. Both former and existing employees also feel shafted (read some of the 135 comments on my post about the last round of layoffs, which somehow became an unofficial forum for employees to vent). They never got a chance to sell any of their shares. Full complaint embedded below, via PaidContent. Crunch Network: CrunchGear drool over the sexiest new gadgets and hardware. |

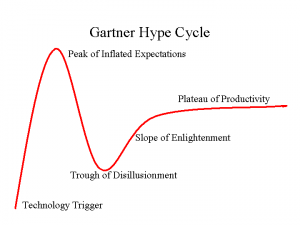

| Bloggers: Let’s Band Together and Stop the Hype Cycle Posted: 19 Apr 2009 12:00 PM PDT

I'm sure you've seen the graphs. If not, it's to the left. In words: A company comes out and no one likes it. It starts to attain huge growth and buzz. Suddenly it's anointed the Messiah. Then something happens. A long time ago, that something was negative: A founder leaving, a down-round, growth that tailed-off or an inability to serve customers. Even then it wasn't necessarily deserved, but the backlash would begin immediately. This company was a laughing stock. What was wrong with them? They'd lost it. They were toast. Well….for another few years. During which a good company would keep growing. And only later, would they get the true credit for what they'd built. Of course, "experts" would claim they got it all along. A great example is Google—a lauded company that was dismissed when it wouldn't immediately monetize with banner ads in the wake of the bust, then re-anointed when the numbers came out at the IPO, and it began its surge past $700 a share. But the hype cycle isn't confined to companies. It can describe waves of technology – like social networking, RFID or the consumer Internet itself—or people. One of the first examples I saw in the Valley was Marc Andreessen. He was built up as the young, shoe-less God of the Internet that the press brutally tore him down once the crash changed the viability of his second company, Loudcloud's, business. It's still deemed a "failure" in some corners of the Valley, never mind that it was painstakingly retooled as Opsware and sold for about the same amount as YouTube. People not only trashed the company, but they retroactively trashed Netscape, and Andreessen himself, saying he'd exaggerated his contributions to Mosaic. Of course, Andreessen kept his head down and kept working. Today he's widely regarded as one of the most important mentors and angel investors of the Web 2.0 movement and one of the only people to found two companies that would end up being worth more than $1 billion each. Sure a smug "I told you so" as you count your millions is the best way to silence and embarrass naysayers; it's the ultimate revenge. But start-ups can take a while to reach their final destination—whether that's bankruptcy or an IPO. Forget cold, in the Valley revenge is a dish served molding and with flies swarming around it. There's an element to the hype cycle that reflects human nature. We get excited about technology and tend to overestimate what it can do in a year and underestimate what it can do in ten years. That's not all bad: Being underestimated is why a lot of start-ups catch giant companies off guard. But the blogosphere has turned an already frustrating hype cycle manic. The famous example was Cuil—a company lauded in the morning as a "Google Killer" and trashed before our first cups of coffee got cold. Not quite as extreme is what we've seen with the giants of Web 2.0: MySpace, Facebook and– believe it or not– the three-year-old Twitter. As soon as Facebook launched its platform—as if in unison—the media world decided MySpace was a has-been and Facebook was the king. Sure, Facebook is poised to overtake MySpace in the U.S., but by many accounts MySpace is making more money, increasing engagement and is still one of the largest sites on the Web. That should count for a lot. In the last month, it's been happening to Facebook, and it’s even more absurd. The company is still growing, having passed the 200 million or 250 million user mark, depending on who you believe. And other reports, and my own sources, say the company is doing close to a $500 million revenue run rate. Did I mention we're in an epicly bad recession? How is that a failure? Frequently the people calling for Zuckerberg’s head because of recent “failures” have never run a company, and never even met Zuckerberg. I tend to agree with a guy who’s done both: Reid Hoffman, CEO of LinkedIn and one of the most successful Web 2.0 investors in the Valley. “Ultimately you judge a CEO by how well the company is doing, and Facebook is doing pretty well,” he told me a few weeks ago. “I think Mark should answer any criticism by saying, ‘Look at the company; I’m doing fine.’” Did Hoffman like the new redesign? Not especially. But he added this, “It’s good to be bold in what you’re doing; it’s good to be visionary. Personally, I don’t think it was right, but Mark may very well learn from that and the next step will be much more interesting in that direction.” Well said. Guess what, gang? Building a company is hard. No one gets every single thing right. Bloggers harping on each mistake are like the fat guy sitting in the bleachers at a baseball game berating a star player for not hitting a homerun in every at bat. Sure, Facebook’s valuation is coming down from $15 billion. But that was never a realistic valuation for the company. It wasn't even paid by traditional venture capitalists; it was paid by Microsoft and other strategics looking to get a piece of the hot company and not caring what it cost. The company itself didn't value Facebook at $15 billion when insiders sold stock. But is it worth $1 billion or more? Definitely. Even based on a reasonable multiple of revenues. Of the Web 2.0 wave you can count on one hand the companies that can claim that with a straight face. Even more absurd: Now bloggers are starting to say Twitter is done. I thought it was only now hitting mainstream? It's one thing to take a company like Cuil—that arguably over-represented what it could do—from hero to goat in less than an hour. It's another thing to trash a company that's only a few years old, growing exponentially, well capitalized, and conservatively run with about 30-something employees. (Let's not even bring up the free Sprint ad and the barrage of John Stewart-Ashton-Larry King-Oprah free press.) Look, we all do it to a degree. We fall in love with technologies, and readers and editors suddenly get an insatiable demand for stories about them. It’s reporters’ and bloggers’ jobs to give them what they want, right? But that tips into link-baiting, blindly aiming for that TechMeme traffic and writing a provocative headline that the story doesn’t even necessarily back up. It’s one thing to be the early adopter who gets bored once something is mainstream. It’s another thing to write off a company for the sheer fact that it’s successful, and you’re bored writing about it. Here's the thing: Great start-ups can survive the hype cycle. Horrible companies were going to fail anyway. That may leave some marginal ones in the middle, but let's argue if the press tanks a company, it wouldn't have gotten far ultimately. So maybe the hype cycle doesn’t really do any harm. But who does it help? As bloggers and reporters we're supposed to bring people reality and truth. No phase of the hype cycle is reality: Not the messiah, not the goat simply because big press has grown weary of the topic. Crunch Network: CrunchGear drool over the sexiest new gadgets and hardware. |

| French Fury: Parisians Hit The Streets In Protest Against Facebook Redesign Posted: 19 Apr 2009 11:43 AM PDT

Granted, Facebook’s recent redesign came with a couple of flaws, and lots of people were upset about the changes, but resorting to street protests to try and turn them around? Apparently, a few people have gathered in Paris to protest against the changes in Facebook, and Alex van Herwijnen was nice enough to send us some pictures he snagged while visiting the French capital. The protesters can be found at the Arche de la Défense, holding signs saying that they’re against the new version of Facebook and that they want the old one back. Clearly, they’re not happy with the redesign even if Facebook has already made some changes due to user complaints (against Michael’s advice), or maybe they’re just really pissed because it’s still confusing their mothers. From the looks of it, this is probably a prank or more likely part of a video shoot or something. TechCrunch France’s Alain Eskenazi and I looked around for reports in French media, but couldn’t find anything. I also did a quick search on Facebook to see if there were any related groups or events on the site, but had trouble finding anything in the messy new interface. Maybe I should head down to Paris and voice my complaints with the other protesters?

Crunch Network: CrunchBase the free database of technology companies, people, and investors |

| You are subscribed to email updates from TechCrunch To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Inbox too full? | |

| If you prefer to unsubscribe via postal mail, write to: TechCrunch, c/o Google, 20 W Kinzie, Chicago IL USA 60610 | |

Late last night, former Engadget editor-in-chief Ryan Block

Late last night, former Engadget editor-in-chief Ryan Block  But, remember that Thursday was the crazy race between Ashton Kutcher and CNN to be the first Twitter user with a

But, remember that Thursday was the crazy race between Ashton Kutcher and CNN to be the first Twitter user with a  At last week’s

At last week’s  TiVo’s growth has stopped, and in fact, its user base is dropping. There’s too much competition in the DVR market from the big cable companies who offer the same service at a lower price bundled with the cable boxes you need to have anyway. So TiVo needs a way to make more money. Selling customer data is always a good way to do that.

TiVo’s growth has stopped, and in fact, its user base is dropping. There’s too much competition in the DVR market from the big cable companies who offer the same service at a lower price bundled with the cable boxes you need to have anyway. So TiVo needs a way to make more money. Selling customer data is always a good way to do that. The guest post below was written by

The guest post below was written by

Earlier today I covered two new URL shortening services,

Earlier today I covered two new URL shortening services,

Silicon Valley is known for nurturing start-ups in a way no other place can. But it's not all kumbaya here. And one of the most destructive things about Silicon Valley is the

Silicon Valley is known for nurturing start-ups in a way no other place can. But it's not all kumbaya here. And one of the most destructive things about Silicon Valley is the

No comments:

Post a Comment